As you expand your investments, you might look into individual stocks or even day trading.

Yet a challenge will be knowing which stocks might be a good investment.

After all, there are thousands of companies that trade publicly around the world!

The best way to get started is to use stock screeners, which can help you navigate and research companies before investing a single dollar. And these screeners can also help you look into index funds too.

But what exactly are stock screeners? What are all the benefits of using a platform? And what are the best stock screeners to choose from? Below is everything you need to know!

What Are Stock Screeners?

A stock screener is an online tool for investors to help determine the most profitable investments. Based on the individual investor’s criteria, stock screeners help filter out specific factors, allowing investors to analyze picks on a deeper level.

In theory, this should aid with overall profitability, but do stock screeners actually work?

Stock screeners can’t outright pick the best performing stocks. They require a knowledgeable investor who can select the right criteria and make sense of the numbers. They also require strategy.

For example, those concerned with growth may look at the year-over-year earnings growth and only pick stocks above a certain threshold.

Therefore, stock screeners are unlikely to be useful for investors without a clear set of rules. But for those with a good knowledge base; stock screeners can save time and increase your picking efficiency.

Benefits of stock screeners

One of the major benefits of stock screeners are that they can help you take the emotion out of trading. After your strategy is outlined, there should be a clear set of technical rules for each of your stock picks.

Therefore once inputting onto a stock screening system, you’ll be left with only the stock picks that fit your criteria. These tools also work to reveal new investment opportunities that may not have already been presented.

It’s important to note that stock screeners are separate from stock scanners. Scanners will look at real-time information to help active traders who need the most up-to-date information. Alternatively, screeners will take historical data and give you more detail about trends for future stock picking.

Best Stock Screeners for Investing or Day Trading

Below are some of the best stock screeners to consider using. There is no particular oder to any of these and each platform has great features.

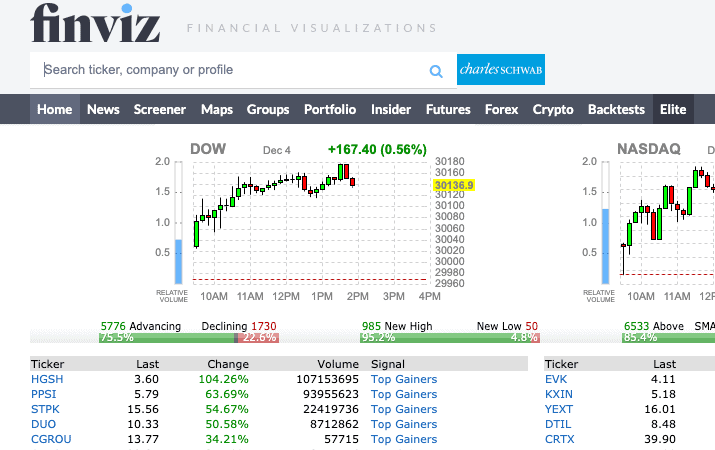

1. Finviz

Financial Visualizations (Finviz) is an incredibly detailed stock screening tool; making it quick and easy to find a macro market view and great for beginners.

It uses real-time data and has capability for back-testing, making it a strong choice.

Plus, the majority of its features come with its free version; although you can upgrade to get several more advanced capabilities.

2. Stock Rover

Stock Rover integrates with your brokerage to rebalance your current investments. It offers the widest range of financial indicators, which allows for very robust reporting.

However, it only offers 9 technical indicators, so may be better-suited to long-term trading strategies as opposed to day trading.

Once again, Stock Rover has both free and paid options depending on the features you need and is brilliant if your focus is on the American or Canadian stock market.

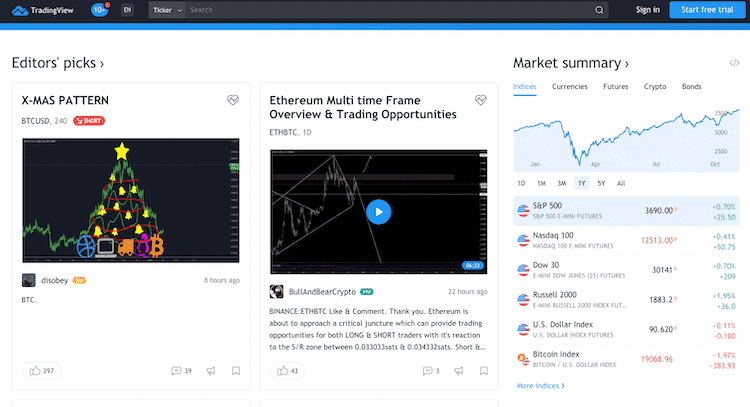

3. TradingView

Trading View is perfect for the seasoned stock screen user, offering a trading social network alongside its other functions to build a trading community.

It’s functionality and layout are quite smooth and simple, plus you are able to create as many watchlists as you’d like.

However, real time charting is not available on its free plan, so one of its four tiers of paid plan might be the best option here.

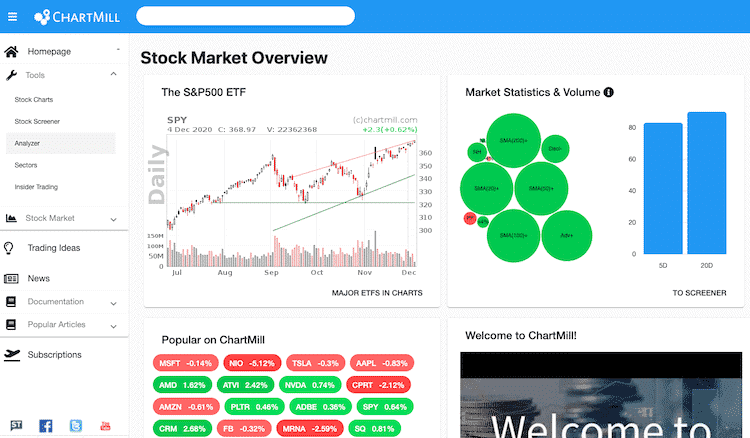

4. ChartMill

ChartMill utilizes a credit-based payment system in order to give paying users access to all areas of the platform (if required).

It’s flexible and highly customizable charts give way to a wide range of indicating factors, but this stock screener is better-suited for long-term investors or swing traders.

As real-time information is delayed by around 15-20 minutes; day traders would be acting on outdated information.

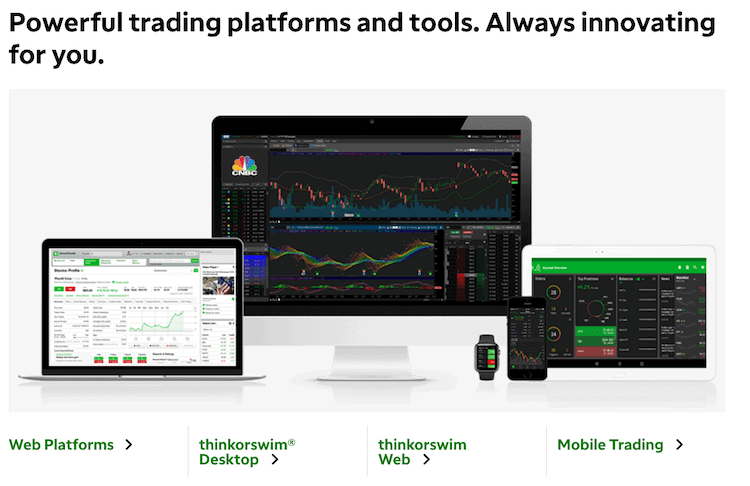

5. TD Ameritrade

When trading in the American markets, TD Ameritrade might be one of the best options.

It’s “Thinkorswim” feature gives you an accessible desktop trading experience, and offers a breadth of education resources which are perfect for beginners.

Plus, most of its features are totally free and all trades within the platform itself are commission-free.

The one downfall to TD Ameritrade is its lack of access; it’s only open to U.S. residents and doesn’t accept credit, debit or bank transfers for your account funding.

6. Zacks Stock Screener

Zacks is a good choice for traders interested in mutual funds, but who require a little more market research or would like advice from the experts.

One of the key features is its own mutual fund ranking system; which tracks almost 20,000 different mutual funds and provides a recommendation on whether to buy. This is based on a 1-5 scale.

It’s based heavily on quantitative analysis, but most of the worthwhile features on this platform require a paid subscription.

7. Atom Finance

Atom Finance provides a free platform for individual investors and integrates wholly with brokerage accounts in order to provide a seamless experience.

The sign-up process is fast and overall site navigation is simple and easy. There is also a premium upgrade for more stock screener features.

The Atom Hubs feature allows you to collect all of the relevant research, articles and information alongside your watchlists, giving you more confidence to make real-time decisions.

8. Trade Ideas

Trade Ideas utilizes the most up-to-date AI technology in order to aid trading suggestions, programming millions of different scenarios at once.

It’s certainly a valuable asset, including auto-trade capabilities based on your strategies and rules.

However, the free version is limited so this would only be a good choice if you are willing to pay for the premium account.

9. Benzinga Pro

Benzinga Pro is an all-in-one stock buying and selling scanner with instant desktop alerts and real-time capabilities.

The platform has its own staff news section for headlines with original content and its Audio Squark feature is certainly something to write home about.

This reads out alerts and real-time updates which are useful for short-term traders.

How These Stock Screeners Work For You

On first glance, a stock screener can look like a complicated program for anyone other than Warren Buffet, but once you know how to use the software; you’ll easily find what matters for the criteria you’ve set.

These screeners can track a number of characteristics, for example:

- Stock exchange

- Country

- Industry

- Market capitalization (cap)

- Dividend yield

- Share price

A stock screener will show you charts containing specific variables; and then determine if they follow other successful chart patterns. This can help you to decide whether to invest.

Remember that it’s only a tool, so requires you to input and follow the chosen strategy.

For example, when you follow a “break out pattern” a stock screener might better aid you in predicting when a stock will go above a key share price.

You should use a stock screener to backtest your patterns and criteria. This puts no money at risk; while sizing up your strategy against previous stock market activity to highlight how effective it really is.

In essence it tells you whether or not your investing strategy would have been successful on real market results, and can give you the confidence to move forward.

Features to look for in a stock screener

There are quite a few stock screeners out there and some are better than others. Some of the key features to look for include:

- A saveable criteria so that you do not have to enter the exact details each time you return to the page

- Back-testing requirements to show the historical analysis of your strategy

- The date of each piece of company information (as it is unwise to invest based on out-of-date information)

- A help or examples screen where you can find out more information on usability

Picking a stock screener

Each of the stock screeners mentioned above have different features and it can be hard to decide between them or determine which one is best for you.

A good stock screener should give you some level of flexibility or customization; focusing on the key metrics that fall under your trading strategy.

You might also like to look for stock screeners with qualitative information, such as legal matters and news headlines that the company is involved with.

Screeners like Benzinga Pro may work well for this as they offer an original content section; whereas Atom Finance provides 100% quantitative data.

Finally, if you’re focused on short term day trading, then real-time updates will be key to enforce your strategy.

Remember that all investments carry risk and that profit is not guaranteed; so it’s good to practice your strategy by backtesting so that you can go forward having confidence in your stock picking abilities.

Should You Invest In Individual Stocks?

I won’t spend much time going over individual stock investing, because there is plenty to cover.

But when you start investing, I typically recommend to start with something like Vanguard Index Funds. As you grow your wealth and expand your investing interests, some individual stocks can be good to mix in.

Ultimately, it’s a personal choice and what you are willing to risk. But below are some quick pros and cons of individual stock investing.

Pros

- More control of your investments

- Easier to manage the taxes on individual stocks

- Easy to buy and sell individual stocks

- Stocks can help you stay ahead of inflation

Cons

- More risk and volatility compared to index funds

- Diversification is harder to achieve

- Requires more time and effort to monitor your portfolio

- Can mess with your emotions and cause you to make mistakes

Tools for Stock Investing

Besides utilizing one or some of the stock screeners above, there are additional tools or platforms to help you. It’s actually quite a large category, but here are two that may be useful to you.

Webull

One the newer stock platforms on the block, Webull is quickly becoming a popular choice among investors. Beside stocks, you can trade options, crypto, and ETFs. Learn more and sign-up for Webull here.

The Motley Fool

Although sometimes their marketing seems scammy, The Motley Fool has a long and trust record of stock investing picks and research. The paid platform does a lot of the research on stocks for you, to help you save time and make money. Learn more about The Motley Fool Stock Advisor program.