While money can buy you “stuff” and experiences, it’s also a necessity to be able to live in today’s world.

Certainly, you can argue for sustainable living or being “off the grid” where money is not of importance, but for the majority of people — that is not of interest.

Yet, in order to have a comfortable life and good financial health, it’s important to understand your cost of living.

This will help guide your decisions like saving money, finding ways to increase salary, and cutting expenses to ensure you are living below your means.

But what does cost of living entail? How do you calculate your cost of living? I’ll explore this and more below. Let’s jump in!

What is the Cost of Living?

The cost of living is how much it costs for a person to live according to their lifestyle, location and preferences.

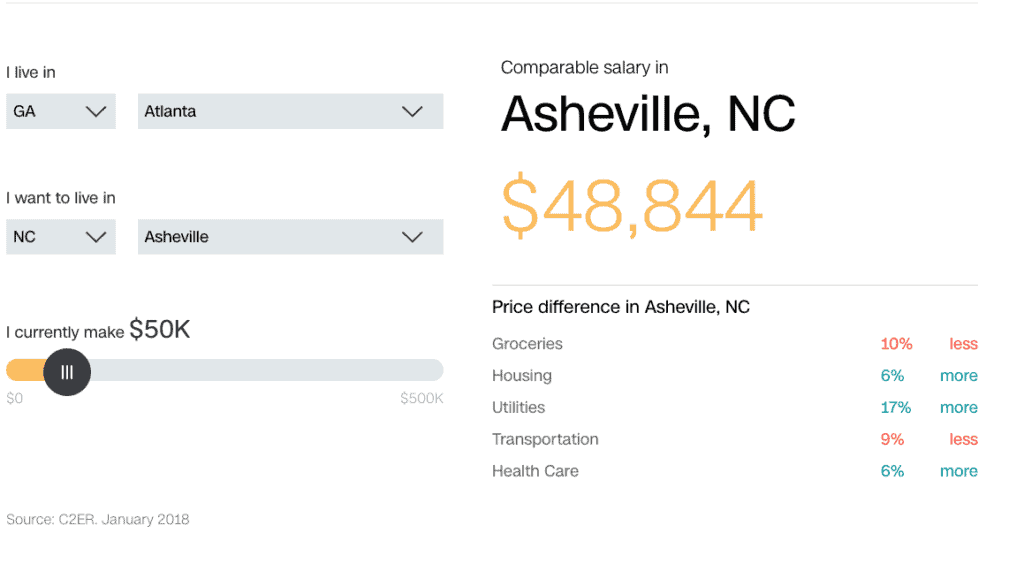

It’s a type of measurement that makes it easy to compare expenses in various locations and different points in time. Many websites and indexes exist to help people calculate and compare the cost of living in different areas.

Having said that, it’s important to remember that expenses do vary depending on what car you use, the type of house you live in and the kind of food you eat – meaning that the majority of the online indexes are mostly estimates.

Your cost of living will include regular expenses such as transportation, utilities, gas, rent and food. It will also include other everyday items such as clothing, internet, entertainment, phone, insurance and car payments.

Why understanding cost of living matters

Understanding your cost of living is important as an individual because it can help you create a budget, make better financial decisions, as well as calculate how much you’ll need to save for retirement.

On a country level, a cost of living index will help you understand whether you can afford to live in a certain area and how you would need to adjust your lifestyle if you were to move there.

Usually, a cost of living is tied to your salary. For example, if you live in a city where expenses are higher, like New York City, then your salary is likely to be much higher too.

Although, I’d argue that the cost of living in New York or San Francisco is ridiculous, but that’s a whole other debate we won’t get into here.

So, your cost of living will depend on where you’re living and your own consumer habits. A good rule to follow in order to estimate how much money you need to live on is the 50/30/20 rule.

The 50/30/20 rule

This rule suggests that 50% of your income should cover necessities such as rent, utilities and food, 30% should be for “wants” such as clothes and eating out, and 20% should be your income saved.

Using this rule you can quickly see if you can afford to live in a certain area and how much money you would need to live on.

However, if you are a personal finance fanatic like me, you might work those percentages differently and lower your expenses and wants, so your savings rate is higher.

How is Cost of Living Calculated?

Your cost of living is simply calculated by adding up all your monthly expenses. That number is how much it costs to live as you for a month in your given location.

There are several cost of living indexes that exist to compare expenses of different people in different regions. They are also helpful to compare how the cost of living rises over the years.

The US government doesn’t have an official cost of living index, but organizations such as Numbeo and Expatistan have some which may be useful.

As mentioned above, your cost of living is the total of your monthly expenses. In order to add them up, go to your bank account statement and check all your expenses for that month.

You may want to subtract what you’re paying in taxes, insurance and 401k contributions, since these are usually taken out of your paycheck before you receive your salary.

You can multiply the monthly number by 12 to get a general idea of how much it costs to live on your standard for a year.

For those that don’t like math or spreadsheets, there are several good cost of living calculators that will help you determine your monthly spending and what it may cost you to live in a particular area.

But remember, with the cost of living data and calculators are just estimates based on various surveys and information.

So these are useful guides if you are considering relocating or looking to understand costs more effectively. However, they are accurate enough to give you the big picture.

How Can You Lower Your Cost of Living?

The simple way to lower your overall cost of living is by:

- Lowering your monthly expenses

- Reducing your “wants”

- Increasing your income

Let’s break these down a bit more.

Track and maintain your budget

The main step to lowering your expenses is to track and keep a budget. By measuring what you’re spending your money on, it’ll be much easier to manage a budget and set goals for yourself.

Many people will avoid creating one or aren’t sure where to start. But it will give you an accurate financial portrait and help you stop spending money or become more frugal where needed.

Set a budget by setting goals of how much you want to spend on every category each month.

You can use an online budgeting tool such as Personal Capital, YNAB and PocketGuard, or you can go old school with an Excel spreadsheet or pen and paper.

If you struggle with budgeting, make it a daily habit to check your expenses and budget to see whether they align.

You’ll eventually get into the habit of doing a budget and keeping your expenses low. It’ll also help you make sure you aren’t overspending on certain categories or items.

By living below your means, you can make sure you’ll always have something to save and that your cost of living isn’t rising.

Reduce necessities

The second main thing you can do to lower your cost of living is to reduce your necessities to a minimum. This means finding a way to pay less in rent, lower your mortgage and pay less in utilities and insurance.

Make sure to keep into account that your cost of living does vary from state to state and city to city, so your utilities may be more if you’re based somewhere like NYC or LA.

When it comes to lowering your necessities such as phone, internet and TV, make the effort to find the lowest prices possible. Many of these come in packages which can end up being confusing, so it may be worth shopping around and comparing different prices and policies for you.

You can use something like Trim, which helps you reduce fees and negotiate bills for you to keep your costs lower. They have some free services that might be worth checking out.

If you can, try to raise your deductibles for your home and car insurance. A $300 deductible can make a big difference in premiums from a $500 deductible.

Some other tips to lowering your utility bills is to simply consume less electricity. An easy way to do this is to simply turn items off when you aren’t using them, and keeping home temperatures at a reasonable level.

No duh right? But as simple of advice as that is, you’d be surprised of the bad habits we don’t realize we are doing that are costing money.

Spending less on “wants”

The third main method to cutting living expenses is to try lowering your “wants”. This could be something like reducing the amount of times you go out to eat at a restaurant.

Going to restaurants once a month instead of every week can easily add $200 to your budget, which will in turn help lower your cost of living.

Other ways to reduce “wants” are:

- Going on cheaper vacations

- Using more public transportation, walking, or riding a bike instead of using your car

- Replace your devices every few years instead of every year

- Stop buying stuff just because you can

- Learn to control impulse shopping and instant gratification

That list of course is much larger, but all impact your cost of living and your financial health.

Another substantial way to lower your expenses is to sell your car (pending where you live and work). This saves you money on car loan payments, gas, insurance costs and overall maintenance and parking.

You’ll be able to use the extra money for rent, savings, and other expenses, and can easily use Uber or public transport to get from A to B.

Increasing your income

Finally, another way to increase the gap between your income and expenses is to work on increasing your revenue.

At the end of the day, there is only so much you can reduce when it comes to your expenses. And while it’s important to keep your spending and expenses low, I think we get too hung up on it.

I’ve been an advocate for spending money on things you value, and cut back aggressively on things you realize you do not care about as much.

Yet, even after all that there will be a limit of saving on expenses that you can’t pass. However by working on your income, you’ll be putting less of a strain on your expenses and have more to save more in the long run.

What are some good ways to increase your income? It really does depend on your personal situation.

If you enjoy your job and are good at what you do, consider negotiating a higher salary with your boss or finding a new position that pays more.

If that’s not an option, look into starting a side business, such as selling items on marketplaces, freelancing or participating in the gig economy.

The only thing you’ll need to make sure is to not let lifestyle inflation get the best of you!

When you increase your income it is tempting to upgrade your living because you can afford to. Do not fall into this trap, your back at square one with your cost of living!

Final Thoughts

While costs of goods and living expenses continue to rise, it’s a good idea to monitor your cost living and your current location.

I personally find it frustrating to hear about some states and cities where people are struggling financially or finding it difficult to afford the necessities.

Although not everyone can easily move, it’s important to research affordability and more ideal locations. It can make huge difference in your finances and help you live more comfortably.

If anything, look for ways you can currently lower your expenses, be more strict on spending — while increasing your income.