This post is sponsored by Savology. All opinions are my own.

Have you ever taken a step back and wondered how you can best organize your finances?

Many people try to manage their money, budgets, and investments without ever writing anything down or putting a plan in place. This is a huge mistake!

While that process may work for a bit, it can easily become overwhelming, you’ll start to make mistakes, and may overlook items that cost you. It happened to me!

This is exactly why it is recommended that you start financial planning and create a process for yourself to stay on the right path.

But what is meant by financial planning? Why should you have one? And how can you easily build your financial plan?

What is Meant By Financial Planning?

Financial planning is simply the ongoing process you take to ensure that your current financial well-being is comfortable, that you are not stressing about money now or into the foreseeable future, and that you have a strategy to reach your long-term financial goals.

Think of building your financial plan as a complete evaluation and comprehensive playbook you use to fix current financial troubles and to help you grow financially.

And no matter where you are financially, having a financial plan is for everyone. You may think that this is for the wealthy because their finances can be more complex.

But it’s recommended that everyone should develop a roadmap for themselves.

While you can tackle your financial plan with spreadsheets or pay a financial planner, there is free financial planning software like Savology that makes it much easier and more organized. (More on that later on).

Why Should You Have A Financial Plan?

According to a previous Gallup study, “Only 30% of U.S. households have a long-term financial plan.”

That’s quite low considering how important it is.

But I think many people brush the idea off, say they will worry about it later, don’t know where to start, or generally do not realize how valuable a financial plan is for them.

But based on the above financial planning definition, you probably are getting a good understanding as to why you should have a plan in place.

However, here are more reasons financial planning is important.

- Helps you understand your current financial situation. Everything from expenses, how you’re spending money, current income, savings, investments, etc.

- Ensures you are setting various financial goals for yourself and your family. Like maybe how much you want to be saving, what you want to invest for retirement, etc.

- A financial plan will help you develop a timeline on goals, if they are realistic, and information to help you stay on track.

- It will help you understand your cash flow and spending habits, so you no longer have to guess or manage off the top of your head.

- It can help you catch money mistakes you are making currently.

- Your plan can also show your financial risks you may not have even been aware of before.

- Naturally, a financial plan will help you build wealth. Your plan keeps you informed, making better saving, spending, and investing decisions that grow your net worth.

- You become more knowledgeable with finances and more savvy with your money.

How To Easily Build A Financial Plan With Savology

In the finance world, there is no shortage of personal finance software or money saving apps.

Technology has played a major role for personal finances in the last few years in helping people achieve financial wellness.

One of the best free financial planning software out there is Savology. While the platform might be the new platform on the block, they are looking to make your financial life a breeze.

Savology has created the easiest financial planning software and helps anyone get started in just five minutes.

Regardless of your financial situation, Savology’s platform will provide you with important insights into all of your finances. This includes any insurances, debt, your retirement planning, estate planning, and more.

Additionally, the company is adding more modules that include credit scores, budgeting, in-depth goal setting, and areas of financial literacy to improve your knowledge. And the best part is, Savology is free to use!

The Main Components of Savology

Building a financial plan with Savology serves three main purposes for you:

Help you reach your goals

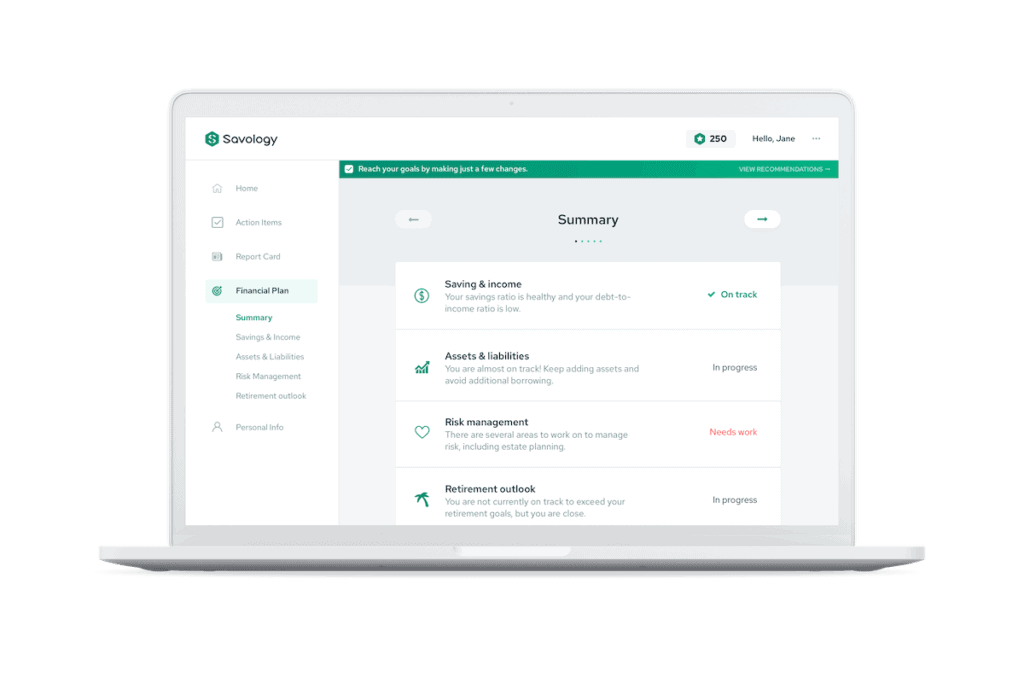

With a financial plan from Savology, you can explore your overall financial strengths and weaknesses, compare your current retirement forecast with your target trajectory, and review your key financial performance indicators.

Discover your financial wellness

Understanding your current financial wellness and health is key. With Savology you can measure your overall progress with grades that are based on 10+ categories. This will help you discover what you are doing well and where you can improve, and then track your progress over time.

Get personalized action items

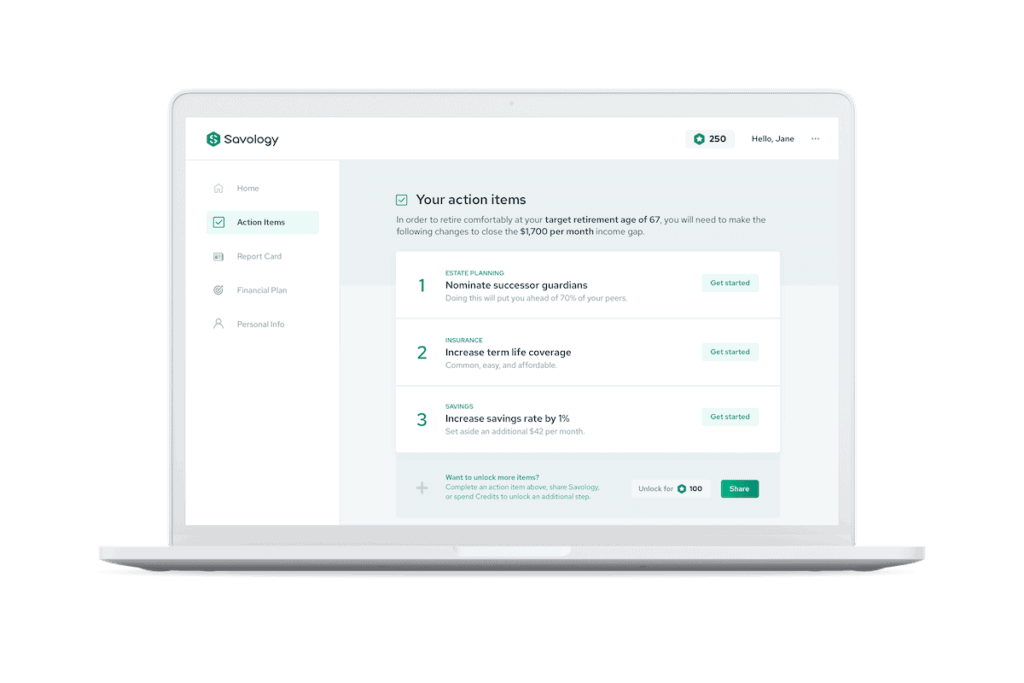

Besides seeing your overall financial plan, you’ll be able to review specific, prioritized recommendations for your unique needs and you’ll be sent tailored partner deals to start improving your finances quickly.

Getting Started With Savology

As I mentioned in the previous section, it only takes a few minutes to build your personal financial plan. Of course, you can tweak it further as you go but getting your account set up is very easy.

Here’s the Savology process.

1. Take the Survey

First, you’ll get started by answering questions about your personal finances in just a few minutes. This information will be used to start creating your financial plan.

2. Get your plan

Then, you create your free account after the survey quests to review your personalized financial plan, report card, and any action items.

3. Improve over time

With your account and financial information you can now maintain your plan, track your progress on specific items, and begin improving your financial life.

4. Update and complete your action items

Based on your information and goals, Savology will prioritize and generate the steps you need depending on where you are in your financial journey. When you complete each of the tailored action items, it will unlock additional steps and areas where you can improve your personal finances too.

Ready to get started with Savology? Begin your sign-up process.

How Does Savology Make Money?

So, you might be wondering how Savology is free? After all, businesses do need to make money in some way.

But in order to keep Savology free and helping as many people as possible, the financial platform partners with quality partners in various categories like life insurance, budgeting tools, retirement accounts, mortgage refinance, and more.

If you sign-up for any of their partners, Savology might be compensated for generating the business. This is actually a common model most free financial companies follow, like Credit Karma for example.

But, Savology only partners with the best companies and the ones they feel will provide the most value if you were to sign-up with any of them.

Some of these current providers include MassMutual, Credible, Policygenius, Ladder Life, Credit Karma, Lively, M1 Finance, Acorns, Blooom, and many others are in the works.

And don’t worry, Savology keeps your information private and does not sell or share any of your information.

When you build your plan, you’ll notice that Savology limits the personal information collected by not asking for sensitive information such as your last name, social security number, date of birth, or phone number.

What is the Best Free Financial Planning Software?

One of the best free financial planning software out right now is Savology. The company was only founded in 2019 and has already helped over 10,000 people with their financial planning efforts.

And just recently they raised money from prominent investors in the financial industry to expand their reach to more households looking for financial help.

According to their recent press release, Savology plans to use this funding to help 100,000 users build free financial plans this year.

Ready to get started with Savology? Begin your sign-up process.