As you work towards bettering your personal finances, you may find it challenging to find ways to save money and keep tabs on spending.

You might also be trying to figure out how to save the most money and keep all your bills at a reasonable prices.

After all, everything continues to rise in cost and it can be frustrating to try and get a head.

This is where the Trim app can be a valuable money tool for you. While this tool won’t help you build your wealth, it will save you a few hundred dollars — maybe even thousands — a year.

In addition, Trim has some other interesting features you might want to take advantage of too.

Below, you’ll read my Trim review, what the product offerings are, and why this is a great finance assistant for you. Feel free to use the table of contents to jump to your desired interest.

Quick Review: In short, I RECOMMEND Trim to help save money and remove unwanted subscriptions, giving it a 8.5/10 score. You can sign-up for free here to start saving money, negotiating bills and bank fees, and more.

What Is The Trim App And How Does It Work?

As you might be aware, the financial technology (or Fintech) industry has grown in the last few years. Many ideas and companies have released interesting apps and products to help people with their everyday finances.

Trim is one of those technologies. The company offers some great features to keep your money organized and to understand your current spending.

But, here is how the Trim app works in a simple overview.

Think of Trim as your very own personal financial assistant that keeps track of your finances for you and alerts you of various things.

The application will analyze your spending patterns and find ways that you can save money by providing recommendations.

Of course, it goes a bit deeper than that. So let’s go through the main features of Trim and see how it can benefit you.

Trim Makes The Most of Your Money

While the Trim app is your AI financial assistant, it really does go to work for you in order to save you more money.

Once you connect your financial accounts, it will begin scanning, looking for recurring charges, and alerting you via text messages about what is going on.

In addition to that information, Trim can handle a few other areas of your money.

Negotiate Your Bills For You

We are in a world where we want things to happen fast and done for us. Whether you think that is just laziness or a cool convenience, it’s an offer that the Trim app has.

It seems like every year, our bills are going up. While some may only be a few dollars here and there, it really starts to add up over time.

And some of these companies are hoping you feel it’s not much money and that you don’t want to deal with reaching out.

Yet, then all of a sudden you realize how much more you are paying and you’ve wasted hundreds of dollars. It sort of feels like you’re getting ripped off!

Here is where Trim can help.

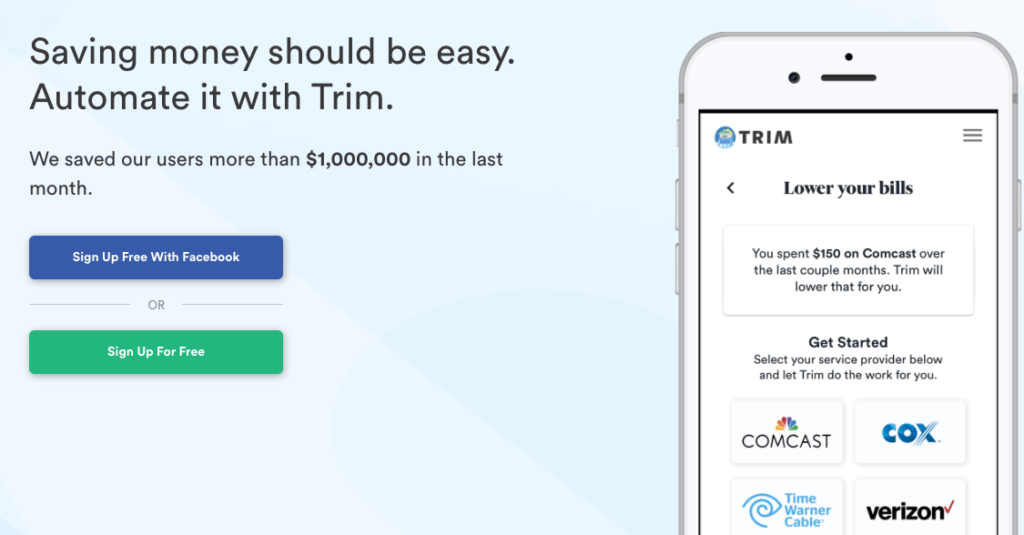

The app can negotiate all of your accounts and ensures that you are getting the best possible rates. Trim works with companies and well-known brands like Comcast, Time Warner, Verizon, and generally most other providers.

How long does trim take to negotiate?

A question you might be wondering is how long will it take Trim to take to negotiate for you. As you may know, negotiating bills can take some time.

But Trim aims to move relatively fast on your behalf once you give them the approval to do so.

Based on the results, if they can negotiate successfully on your behalf, you’ll see money savings reflected in your bills in 1-2 months tops.

And if there appears to be more opportunity to save money later on, Trim will let you know!

Find and Cancel Unwanted Subscriptions

You ever sign-up for random things, maybe it was a free trial at first then turned into paid, but you left it go? Maybe not, but many certainly have.

Plus, if you generally are having a hard time sitting down and going through everything, you may just shrug your shoulders and pay it.

But with Trim, you can let the app find these transactions and recurring payments.

From there, you can ask Trim to handle it for you to remove unwanted subscriptions and cancel it on your behalf. Yup, a simple click and money is back in your pocket each month.

Lower Bank Fees And Interest Rates

Don’t even get me started on banking fees and ridiculous interest rates on credit cards! It’s insane what some of these financial institutions get away with charging you.

You know what I’m referring to, like those random “maintenance” fees, transfer fees, etc. If you have a well- known big bank then you probably have seen these before. (It’s why I’m starting to really like these online banks only instead).

But besides negotiating bills, Trim can also handle working with banks to waive fees or get refunds on lame bank fees.

The app can also do the same with your credit card provider to help lower the high interest rates. Boom!

High Yield Savings Account

Almost every financial service or application these days seems to have a high yield savings account.

I almost always roll my eyes to that because it seems random at times given what the application might do. Like not long ago Credit Karma began offering one, but hey good to have options too I guess!

Anyway, Trim also offers a high yield savings account that you could take advantage of to if you wanted. And their offering is actually pretty decent as well.

You’ll get a 4% annualized bonus on your first $2,000 and then just over 1% interest after that. And all funds added to your savings account with Trim are FDIC insured up to $250,000.

That’s always key, to ensure your money is safe if something were to happen to the company.

Does Trim Cost Money?

The above all sounds pretty awesome right? Great idea, simple, and helps you take on financial tasks you probably do not want to deal with.

So, the big question is does Trim cost money to use?

The freemium model

Signing up for a Trim account is actually completely free but with some caveats.

Your free account will give you access to a personal finance dashboard, personalized spend alerts and reminders, detection any overdraft fees, helping you find and cancelling old subscriptions, and more.

So that’s pretty sweet! And a decent amount of options for a free version.

The paid model

With any financial company, they are a business and need to find a way to generate some sort of revenue. Here is how the company makes money according to the Trim website.

If you are looking for the bill negotiation, debt payoff, and use the Trim Simple Savings, there will be fees associated with these features. Payment for these features varies and will be explained before you sign up for the specific feature.

So as an example, let’s take the bill negotiation feature.

If Trim ends up being able to save you money on their negotiation on your behalf, they’ll take just over ⅓ (33% according to their website) of your total yearly savings.

To put that in numbers, if they save you $10 each month for 12 months, then they’ll only take $40. That still leaves you with $80 back to you.

Lastly, Trim is also paid by some third-party partners, such as credit card issuers, for referring customers to them. This is pretty standard for many financial companies, but if you can choose to ignore those offerings.

Is Trim Safe?

One of my biggest concerns (as it should be for everyone) is the safety of your financial information. It might be a bit scary to think about linking financial accounts and granting access to everything in one location.

So when you are looking at any financial service or application, always review the secure options.

Trim does a great job of helping protect their users, below are a few of their features to ensure your data is safe:

- 256-bit SSL encryption, which is basically the standard in retail banking

- They use encrypted databases and two-factor authentication or OAuth when you sign in

- Data is not shared with third-party vendors

- They use a service called Plaid to securely connect to more than 15,000 financial institutions across the U.S. During the registration process

- Those credentials are never on Trim servers, nor are they stored by them. Your credentials are sent through Plaid to your bank or credit card provider. Plaid then sends back an encrypted token to us.The token provides read-only access to your transaction data

- You can revoke their read-only access token at any time

Is the Trim App Legit?

So is Trim legit? Yes! The AI powered application is a great free tool to use to help you save money, monitor subscriptions, get real-time recommendations, and more.

It’s not made to be an intense budgeting tool, but having real time alerts about your spending can really keep you on track.

Plus, it helps you get a picture of how your spending and any money you might be wasting on bills or fees.

You might also be thinking, can’t I do most of this on my own? Yes, 100% you can.

There is no guarantee Trim will be successful with every negotiation just like it would if you did it yourself. But if you hate doing this stuff, need help, and rather be hands off — then Trim will be a great option.

If anything, just try it for a bit and see if it works well for your needs. Since it has plenty of power features to use for free, there is no harm it testing it out.

Now if you want to unleash the full power of the Trim app, then you will pay some fees to do so but it can entirely be worth it for you. It comes down to your preferences and financial priorities.

I’ll be watching to see what new and exciting features Trim will be adding in their near future.

Are you using Trim yet? Have you in the past? Let me know what you think of the platform in the comments below!