While owning a checkbook and writing checks to many people might seem a bit outdated, there are still plenty who prefer this method.

And although I am a millennial, I still remember using a “voided check” to set up payroll at one of my first jobs during college.

As checkbooks become a bit more obsolete, it’s still good to have them at your disposal and you might be surprised how many people are still writing checks consistently.

Sometimes writing a check is easier if you are not comfortable with managing your finances all online or using apps.

There might also be situations like my example above, where a voided check is just the quickest and the best option to set up payroll.

What Is A Voided Check?

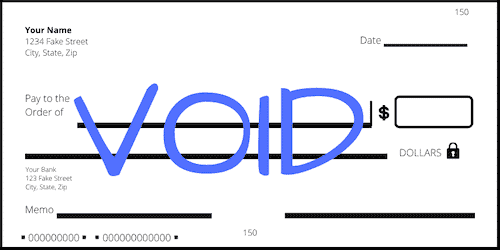

A voided check is a check that can no longer be accepted as payment from anyone. It has the word “VOID” written across it and therefore is not a blank check either. A voided check will still have your account details on it but it cannot be used to process any payment.

When I first learned about voiding a check from my parents as I needed to set up my direct deposit from my first job, I was a bit confused.

Of course it takes a whopping two seconds to do, but as a young impressionable teen at the time, being clueless about most financial things was quite common.

Did you know? Digital banking stats predict that the total number of online and mobile banking users will exceed 3.6 billion by 2024! (Source)

How to Void A Check

It’s easy to void a check: you just need to grab a blank check from your checkbook and write the word “void” in large letters across the front of your check.

You’ll want to write it in letters that are large enough for anyone to read, and you’ll want to write in a large, thick pen, if possible. You won’t need to sign it or add any other information.

Once you’ve voided your check, make sure to keep the correct records. You’ll want to make a note in your checkbook that this check was voided. Simply write VOID, with the check number and date and then add a note with the name of the recipient you gave the voided check to.

You should also create a copy to have for your own records. Whether scanning it on your computer or keeping a picture of the voided check on file.

To send the check to the recipient you can send it by mail, hand it in person or take a photo and send it by email.

If you’re going to send the voided check electronically it may be a little risky to send it through a normal email sender. If possible, send the image through a secure and encrypted sending platform.

Tip: When writing “VOID” do not block the account number or routing numbers at the bottom of the check. This is the info the recipient needs to be able to send payment directly to your account.

This is what a voided check looks like:

Ready to close a bank account and open a new bank with better options? Consider some of these banks below:

| Best Online Banks | How to Bank Better | Get Started |

|---|---|---|

| Online Banking Savings Builder | Learn More |

| Online Banking Rewards Checking | Learn More |

| Rewards Checking Financial Tools | Learn More |

| Socially-Conscious Banking Fee-Free ATM | Learn More |

| Savings Account No Minimums | Learn More |

| Online Banking Interest Checking | Learn More |

| Mobile Only Banking Get Paid Early | Learn More |

Reasons You May Need to Void A Check

1. You’ve made a mistake

Instead of trying to correct the error you may have made on a check, it’s better and safer to cancel the check completely by voiding it.

When I used to write checks a lot for bills and other payments, occasionally I would write the wrong amount or accidentally spell something incorrectly.

In this case, you just write void across it and keep it in your records. This way, if your check gets lost, you won’t have to worry about it getting in the wrong hands.

2. You need to receive direct deposits

The most common reason to send a voided check is to share your account details with an employer. If you recently changed jobs or bank accounts, for example, your employer will want your account information and may ask for a voided check.

This information will allow them to set up a direct deposit for your salary into your bank account.

It also makes it easier for your payroll department to know the account number and routing number, plus avoids mistakes like mishearing what you told them or mistyping if you did not give them a voided check.

3. You need to set up automatic payments

You may also need to send a voided check if you need to sell up automatic bill payments or regular investment contributions.

Many times, it’s as simple as entering the information in your online portal for any financial institution or billing account.

But if you aren’t active online for your finances or feel uncomfortable with that, then a voided check will work too. Some places may require a voided check to receive your account information and even get set up an electronic transfer of your money too.

4. You want to cancel a check payment

If you’ve completed a check but want to cancel it, simply taking it back and voiding it makes it financially empty and therefore cannot be used to deposit a payment.

This also applies if you have made a mistake when writing a check (like the wrong dollar amount), so voiding the check ensures it can’t be processed by any bank.

What To Do If You Don’t Have Checks

As you have read above, voiding a check is super easy to do. However, it’s also likely you don’t have a checkbook anymore, even if you have multiple bank accounts.

So how can you send a voided check? Here are a few options for you:

Go online

Many companies and websites allow you to set up an electronic bank transfer entirely from your online banking.

Instead of voiding a check and submitting it through a form, you can now set up your direct deposit or automatic payment through their online system.

You’ll just need your bank details at hand and then input them directly. Your bank’s routing number is usually written on their homepage of their website and you can find your account number when you sign-in.

Counter check

Counter checks can be obtained at pretty much any bank branch near you. Counter checks are simply a check that the bank teller prints with your account information on it.

You can then treat it as if it came from your checkbook and then void it right there. Remember though, your bank may also charge you a fee for this.

Deposit slip

A deposit slip acts similarly to a voided check — it’s simply a piece of paper with your account details on it.

You may be able to find some of these pre-printed slips in your checkbook, or you can simply head to your closest bank branch and ask for one. Most places where you need a voided check should accept this since it includes the appropriate account details.

Printed letter

If you’re really running out of options, you can try printing out your account details on a piece of paper at home.

Make sure it includes your account number, account type and routing number — if the recipient just wants your accounts details, that should be enough. But verify from the recipient if this would be acceptable if you have no other options.

Voided Check FAQ

Can I get a voided check from my bank?

If you don’t have paper checks, you can still get a check from your nearest bank branch. You can get a voided check by asking a teller to print one for you. There may be a fee for this service, so make sure you ask before you start the process.

Why do you need a voided check for direct deposit?

In order to set up a direct deposit, your employer will need your account details. They may ask for a voided check because all your account information can be found on there including your account number, account type and bank routing number.

Do I sign a voided check?

When you need a voided check, all you need to do is write “VOID” across the front of the check. You do not sign a voided check as it is unneeded and you do not want anyone to make copies of your signature in case it gets lost or stolen.

Is it safe to send a voided check via email?

There are safer methods to send a voided check: you can ask your employer to use a secure website or to use an encrypted sending service. Make sure to keep a copy of the records you are sending over.

Can you get a direct deposit without a voided check?

By simply providing your account details you should be able to set up a direct deposit quite easily without a voided check. As long as the information is copied adequately and the recipient says it’s fine. Otherwise a voided check or copy of a check will generally be the ideal method.