This post is sponsored by DiversyFund. All opinions are my own.

When it comes to investing money, one of the necessary things to do is to diversify your investments.

And while stocks and bonds are commonly the top investment choices, you need to go beyond the stock market to really build wealth. This is where investing in commercial real estate comes in.

By putting a percentage of your money into real estate, you are not only diversifying your portfolio further, but helping grow your net worth much quicker.

Below I’m going to dive into investing in commercial real estate, the pros and cons, and how you can invest in commercial real estate online, without having large sums of money or the hassle of negotiating and managing properties.

What is Commercial Real Estate?

Before considering investing in commercial real estate, you need to understand exactly what it is first.

Investing in commercial real estate (often abbreviated as “CRE”) means you are making investments in buildings or land intended to generate a profit, either from capital gains, dividends, or rental income.

Commercial real estate is often labeled as an “alternative investment,” because it doesn’t fall into conventional investment categories (like stocks, bonds, or cash).

Investors have access to commercial real estate by purchasing physical properties, via Real Estate Investment Trusts (REITs), or exchange-traded funds (ETFs).

Traditionally, investing in commercial real estate has been for high net worth individuals, because owning commercial properties would require significant capital.

However, with online platforms like Diversyfund, the need for high capital upfront is no longer necessary. But more on that in later sections.

The Five Types of Commercial Real Estate

Now that you know what commercial real estate is exactly, you probably have a good idea of the types of properties that would fall into this category. But, let’s explore these a bit further.

Office Buildings

When you think of commercial real estate, office buildings will probably be the common assets that come to mind. These can be buildings like skyscrapers to the more traditional suburban office buildings you see in your town.

Retail

In commercial real estate, retail buildings are also widely popular investment assets. Think of places like restaurants, malls, community centers, drug stores, etc.

Industrial

Industrial buildings house industrial operations for a variety of tenants, and are mostly located outside of urban areas. Many of these will also be found in designated industrial parks, which you might have near you. Think warehouses, smokestacks, heavy manufacturing, etc.

Multifamily

And another popular category of commercial real estate investing is multifamily. You might not have thought of this at first, but apartment complexes and high-rise condos fit in the “CRE” category. If the building has more than four units for living, it can be classified as commercial.

Special Purpose

These are commercial properties that do not fit into the above categories, but are used for specific use and cannot be served for any other purpose. These kinds of properties include amusement parks, stadiums, airports, car washes, self-storage, etc.

The Pros and Cons of Commercial Real Estate Investing

Anytime you are investing your money in different assets or funds, there will always be some pros and cons.

And there are many things to consider when investing, but always remember that diversification is key to your success.

Let’s look at some of the pros and cons of investing in commercial real estate.

The Pros of Investing in Commercial Real Estate

If you are looking for more ways to build wealth, grow your net worth, and diversify your investments, then commercial real estate is a great option. Here are some of the common benefits to considering CRE:

- Great portfolio diversification: historically if the stock market is suffering, commercial real estate is typically not affected. So these investments is a popular option to protect against volatility of the stock market.

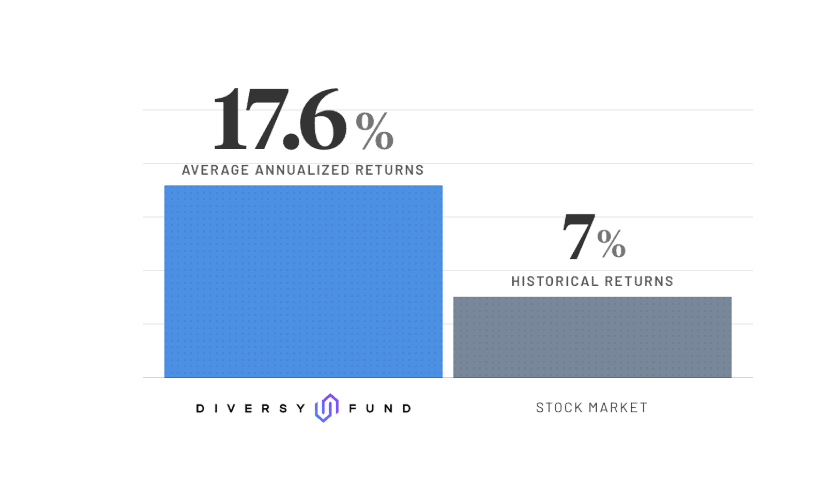

- Higher yielding returns: commercial real estate presents more options for returns from rental income, appreciation, and dividends. Typically, because of lower vacancy risks, longer lease contracts, etc.

- Lower levels of volatility: Commercial real estate is not traded like stocks and bonds, and are less affected by economic news and events.

- Potential for capital appreciation: meaning, the value of your commercial real estate investments can increase in value. Your purchase price can significantly grow, so if you choose to sell you make money (capital gain).

- Tax benefits: As a CRE investor, you can claim deductions to interest income, depreciation, among other items that can help defer the taxes. Always consult a tax expert though with your investments!

The Cons of Investing in Commercial Real Estate

Like any investment choices, there are always some cons as well that you should consider.

- An illiquid asset: commercial real estate is an illiquid asset, meaning you have a longer timeframe where your money is tied up. Real estate is more a long-game approach, so selling is not as simple as a stock or bond.

- Higher capital needed to invest: traditionally, investing in commercial real estate will require much higher upfront capital to get started. However, with REIT’s and advancement in Fintech, this threshold is changing.

- More risks – real estate will naturally have more risk with properties. Think of property damages, maintenance costs, insurance issues, etc.

While there are some disadvantages with traditional commercial real estate investing, the booming Fintech world is helping alleviate some of these challenges.

Investing in alternatives (like real estate) is becoming much more attractive with less headaches, thanks to platforms like DiversyFund.

How to Invest in Commercial Real Estate Online

One of the major benefits of the digital age we live in, is we now have more options for investing and diversifying like the 1%.

Investing in commercial real estate has gotten easier and is giving more investors a chance to build wealth.

Traditionally, investing in commercial real estate was by actually buying a physical property, direct investing in a partnership that pools multiple people, or publicly traded REITs (real estate investment trusts like Vanguard’s VGSLX).

But these can require a lot of capital, time management, education, or in the case of a publicly traded REIT, will follow the stock market volatility.

Now, you can invest in REITs online, that are not publicly traded and are actual physical properties.

What is Diversyfund?

DiversyFund is an online platform that allows you to invest in commercial real estate funds with as little as $500. They are also the only no-fee platform!

The company’s Growth REIT is SEC-regulated Real Estate Investment Trust (REIT) that builds wealth by investing in cash-flowing apartment buildings.

Their primary focus is on long-term capital appreciation from the renovation and repositioning of the multifamily properties they own. You can check out a full list of their properties along with potential returns right here.

Additionally, the team’s co-founders have a combined four decades of real estate investing experience, ensuring their industry knowledge and purchasing of assets is of the highest quality

The DiversyFund Difference

The primary difference between DiversyFund and competitors, such as Fundrise, is that they are vertically integrated – meaning they do everything from sourcing deals to selling any of the properties.

DiversyFund actually owns the properties (they have a dedicated real estate division), whereas most of their competitors use third parties.

This is the reason DiversyFund is able to eliminate all platform and management fees – as they get money from acquisition/developer fees and therefore don’t need to collect fees from investors.

Additionally, they are not a real estate crowdfunding platform. Their platform is designed for alternative investments – with their goal to make alternative investments that have only been available to the high net worth accessible to everyday people (i.e. non-accredited investors).

How to Get Started In A Few Steps

- DiversyFund is easy to get started, you can create a free account in a few minutes.

- Browse Available Investments – Once you join, you have exclusive access to the current investment funds to choose from. This includes their Growth REIT, which anyone can invest with a minimum investment of $500. This Real Estate Investment Trust (“REIT”) is designed for income and diversification through investments in DiversyFund’s portfolio of properties.

- When you are ready to invest, you can quickly complete your transaction online. If you have any questions you can reach out to us via DiversyFund Live Chat, their Investor Relations Team or by scheduling a call.

- Monitor investments: You have full visibility into the performance of your investment via the DiversyFund Dashboard. Track your total current invested value and review your portfolio. You’ll receive quarterly investment reports and annual tax documents.

Some Quick DiversyFund Facts

Investors are protected by a 7% preferred return to investors before the Sponsor (i.e. DiversyFund) receives any profit split.

After the 7% preferred return, there is a 35/65 profit share between DiversyFund and the investors. Once the investors have made 12% per year, then the profit split hits 50/50.

Unlike other online platforms that function as a broker, with DiversyFund, you get an investment partner with skin in the game.

- They are an all-in-one platform where you can make your direct investment to their assets

- Unlike competitors, DiversyFund has no platform fees because of their vertical integration.

- Their investment will be managed by their team and your return will come under their ownership alone.

If you are looking for more information about their platform, funds, payments, or anything else, make sure to check out the DiversyFund FAQ page.