Ah yes, your net worth. Something that can be scary to think about yet is completely necessary if you want to start understanding your finances.

I’ll admit, it took me a good two years into my journey before I decided to really understand my net worth or have the guts to investigate. But, I recommend for you to check it right now before you start anything else with your finances.

However, before we go any further, I feel it is important to define net worth and share a few stats to get a better picture.

What Does Net Worth Mean?

The definition of net worth is pretty simple but sometimes misunderstood. We can define it as the number of your assets that exceeds your liabilities. Another way to put this is the value of everything you own, minus your debts.

To figure out your net worth, you add up the total value of all of your assets. Then, add up the total value of all of your debts. Now subtract the assets from the debts.

Yes, it might make you cringe if you see a negative number, but this is necessary to do in your personal finance journey.

To be clear, assets would be things like:

- Cash in your checking or savings

- 401ks, IRA’s, other stock investments

- Market value on a home or rental properties

- Cars (if you own it currently)

- Artwork, jewelry, etc.

Some liabilities include:

- Student Loans

- Credit card debt

- Mortgages on properties

- Back taxes

- Medical bills

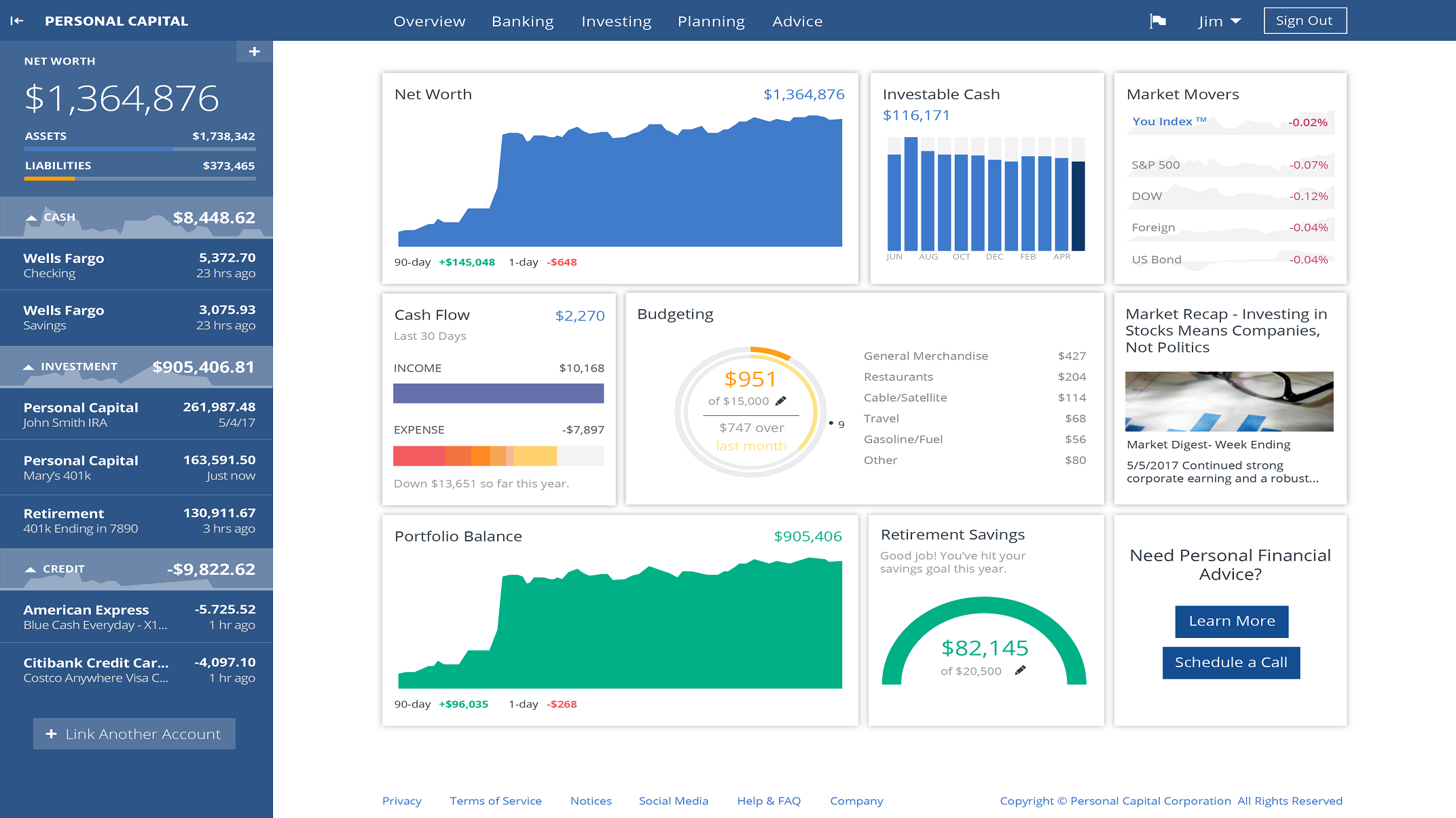

Although the math is not necessarily complicated, you could have a lot of numbers to crunch in each section. I recommend using a sweet free tool called Personal Capital. You can link your accounts and fill out some info, which then calculates net worth, budgeting, investments, etc. Definitely makes your life easier.

What your Personal Capital dashboard can look like. Click the image to get started if you are interested.

Average Net Worth for Millennials

I recently turned the big 3-0 a few months back, so finances have really grasped my life these days. There are quite a few reports of the average net worth for Americans, but I wanted to focus more on my generation, millennials.

One of my other favorite finance sites (besides my own of course), is The College Investor. There was this article on the site talking about the net worth of Millennials, so I took a screen grab of net worth by age for my generation and the numbers are not pretty.

But it makes sense with the amount of student debt, stagnant wages, and add in also having credit card or homeowner debt. So if you calculate your net worth and you were not too happy, you probably fall into the national average so fear not, you are not alone.

Why You Need to Know Your Net Worth Before Developing Your Financial Plan

By understanding your exact number for your net worth, it lets you know exactly where you stand at your current age. It certainly can be discouraging and scary to see the number, but it is critical.

Once you see it, you can come to terms with it. Good or bad, it doesn’t matter because you need to face it head-on.

Your net worth should light a fire under your a$$

Whether you have a negative or positive net worth, seeing the actual number should light a fire under you to make changes, or if anything, to take your finances to the next level.

For me, my net worth is currently just over $60,000.

While it certainly was a bit of relief to be ahead of the curve, it made me want to work harder to get to six-figures. This meant I need to start cutting down on unnecessary spending and boost my savings rate to get more out of my investments.

Hoping and aiming to hit $100,000 by end of 2018. Will keep you posted on my progress (:

Helps you determine what to prioritize in your finances

If you are going into your personal finances blindly, you easily can be making decisions that are not the best for your current needs. Having all your assets and liabilities together in a place like Personal Capital helps you understand all that is good and bad currently.

By seeing this information, you can now prioritize where to focus your efforts that will begin getting your net worth on track. Maybe it’s putting extra money towards debt to pay it down faster, boosting salary in order to save more, etc.

Since my debt was fairly manageable, instead of putting extra on the remaining bit of student loans, I primarily focused on saving more and adding more money to not only my Roth IRA but my brokerage account of investments as well.

I’m of course paying my remaining debt on time and will occasionally put extra towards it, but that has not been my main priority. By doing this, I’ve seen my net worth jump quite a bit in the last few months.

Seeing your net worth also helps you see your spending habits

How many times have you bought something recently but were on the verge of actually not buying it? You think oh I have the money, it’s something I want, and I haven’t spent much recently.

In reality, you’ve probably been overspending on items that really if you took the time to think about it, was most likely an unnecessary purchase. Well, by keeping track of your net worth and using a software like Personal Capital, you can see all your spending and where it’s going.

This can be a real eye-opener and it was for me.

While I never buy much for myself like clothes, entertainment, etc. I’m a big foodie and have an obsession with Mexican food. Seeing my net worth and my spending habits really showed me how much I spent on food a week, which could go to my investments instead. I honestly don’t think I’d realize how much overspending I was doing without seeing those numbers and getting emails from my use of Personal Capital.

You’d be surprised how often you spend money on things that might give you temporary happiness, but instead could be better used for your long-term financial goals.

Final Thoughts

Net worth might not be the most exciting aspect when diving into your personal finances, but it is absolutely necessary.

I was nervous to check at first, to the point where I dreaded seeing the results after I entered everything in. Luckily, by the time I first checked I was in pretty decent shape. But regardless if the number was far worse, it was something that needed to be done.

If you are getting ready to take charge of your personal finances or you already are starting but have not checked your net worth yet, then get those numbers crunching today. Whether you use a spreadsheet or something like Personal Capital or Mint, just sit down and do it.

Your future self will thank you and you’ll be setting yourself up for financial success.