As you start on your financial journey or begin focusing on building wealth, you undoubtedly have come across the term “net worth.”

That is, the total of all your current assets minus any liabilities you have (like credit card debt).

Yet, you probably do not often come across the variation of the term called “Liquid Net Worth,” which is actually a stronger indication of where your current financial health is at.

Luckily, the idea of calculating liquid net worth and understanding it is quite easy. But in order for you to apply it to your finances, I’m going to do a deeper dive below on the term.

Feel free to use the table of contents to jump to different sections.

What is Net Worth And Liquid Net Worth?

Your net worth is the sum of your total assets minus your current liabilities. And your liquid net worth is the number of assets you have that could be quickly sold and turned into cash at a moment’s notice. Essentially, if you had to sell immediately, you’d have no problem acquiring the cash value.

Many celebrities and wealthy business people love to brag about their net worth reaching into the billions — but that doesn’t mean they have a savings account with one billion dollars in it. Or that they have assets that could be sold instantly for cash.

Instead, many of these wealthy people like Jeff Bezos, founder of Amazon, will have most of their net worth tied up into various assets like their company stock, real estate, or other illiquid assets.

This shows that your net worth could be a very different number to your liquid net worth — and it’s worth understanding that difference.

Why Liquid Net Worth is Important

After reading the definition, you might be wondering why knowing your liquid net worth is important. Afterall, it might seem like another vanity financial metric that might be good to know, but isn’t necessary. Well, there are a few reasons why having the full-picture of your liquid net worth matters.

1. You want to know how much you have in case of an emergency

By knowing your liquid net worth, you’ll know how much cash you can access if something unexpected happens and you need a lot of money. Not all assets can be sold quickly, so you want to know which ones you can access if needed.

Say a big medical expense comes up that you are required to pay. If you don’t have all the cash in the bank, it’ll be useful to know which assets you have that can quickly be sold.

2. To know your financial security

Even if there isn’t an emergency happening, knowing how much you have in liquid assets can simply help you sleep better at night and avoid financial stress. You’ll know you can cover any emergencies and you’ll feel confident about any purchases or decisions you’re making.

Of course, if your liquid net worth is really low when you calculate it, that’s okay too! Now you are aware ahead of time and can start pivoting your personal finances to improve that number.

3. To encourage you to create an emergency fund

You should have a few months of expenses saved up for emergencies already — but if you don’t, knowing your liquid net worth will help you start saving towards that fund.

And if you have read previous financial content, you’ve probably been hammered with the importance of an emergency fund.

But seeing that liquid net worth can help kick your butt in gear, before anything unexpected comes up that you can’t cover (like a job loss, medical emergency, etc.)

4. To keep track of your path to financial freedom

Most people base their progress to achieving financial independence on their total net worth. However, knowing your liquid net worth will help you determine how much you can cover for immediate expenses.

If you’re retiring earlier at 40, for example, you won’t have access to your 401ks or other retirement accounts without accruing a penalty. Having a liquid net worth will help you have a more accurate idea of when you could retire early.

What’s the Difference Between Liquid and Non-Liquid Assets?

Liquid Assets

As mentioned previously, liquid assets are those that can be quickly turned into cash and what you’ll receive will be close to the market value of your asset. This could be:

Cash

Obviously, any cash that you have in your savings, checking or a money market account will be considered a liquid asset. This is because you can withdraw your money that very same day and use it for any expenses. And this also includes any physical cash you may have in your purse or pockets!

| Best Online Banks | How to Bank Better | Get Started |

|---|---|---|

| Online Banking Savings Builder | Learn More |

| Online Banking Rewards Checking | Learn More |

| Rewards Checking Financial Tools | Learn More |

| Socially-Conscious Banking Fee-Free ATM | Learn More |

| Savings Account No Minimums | Learn More |

| Online Banking Interest Checking | Learn More |

| Mobile Only Banking Get Paid Early | Learn More |

Stocks & Bonds

Stocks and bonds you hold in a brokerage account are also considered liquid assets. Although you may have to pay capital gains tax if you make a large profit, you’ll usually be able to access that cash within a few days (or faster, pending your broker).

Precious metals

Precious metals such as gold and silver are considered liquid assets since you can usually sell them within a few days. If you hold your gold in a brokerage account (like a mutual fund), you’ll be able to sell whenever the market is open.

And if you hold your precious metals in a safe, you’ll need to make sure a gold or jeweler dealer is open — but you’ll still get your cash relatively quickly.

Non-Liquid Assets

Non-liquid assets are the opposite: those are assets that cannot be converted into cash quickly and may charge large fees when going through the selling process. Some non-liquid assets are:

Real estate

Real estate is a complex asset to hold: it can take months to sell and fees vary depending on where you are and the type of property you are selling. If you want to sell quickly, you may need to reduce the price – which means you don’t really know the value of your property until it’s sold.

You might also be investing in real estate crowdfunding platforms as well, like Fundrise or DiversyFund. These are usually illiquid investments too, as they are long-term investments.

However, you may be able to request your money with some platforms, however you may only have a certain amount of days and/or you only recoup like 95-98% of your initial funds. But if you are strapped for cash, you may be able to get your money back in a few days with a penalty fee.

Business equity

Business equity is another illiquid asset that can be complicated to measure. You’ll need an industry expert to appraise the value of your business equity, and once again, it depends on how “saleable” your business is.

It’s likely you won’t know the true value of your business equity until you sell what you own and that can take time. Plus, you might not be able to do anything with your equity if it has not properly “Vested,” pending the terms of your employment or business.

Retirement accounts

Although you will be able to access your accounts and sell for cash quickly, you won’t be able to access those until you reach the specific age of retirement.

Of course, there is the option to withdraw early, but you will need to pay a penalty and potentially reduce the value of your retirement accounts. This is something you should consider as the last resort, because taking this money can set you back when it comes to your retirement goals and value.

How Do You Calculate Your Liquid Net Worth?

Based on the information you learned so far, it’s quite easy to calculate your liquid net worth.

It’s simply the total amount of cash you would have if you sold all your liquid assets and paid off any short-term liabilities. The calculation would be the following:

Liquid assets – short-term liabilities = liquid net worth

Remember: Liquid assets are anything valuable that you own which you can access or sell quickly, like money, stocks (generally), and jewelry. And liabilities are what you owe, like credit card debt, student loan debt, car loans, payday loans, etc.

Example of Liquid Net Worth

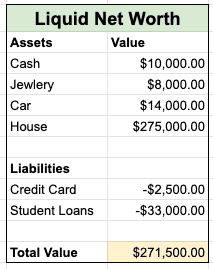

There are two ways to calculate your liquid net worth. Add up all the assets and subtract the liabilities and get your number, like this:

However, a more accurate representation is to use a discount percentage when calculating your liquid net worth. The reason for this is on some of your assets can still take time to sell (like a house) and you aren’t going to get exact market value for all your liquid assets.

For example, let’s say you go to sell your car. A dealer would offer lower than the blue book value and a private buyer will negotiate too. Here, your liquid net worth would look something like this:

While you might opt for spreadsheets or manually calculating this, it can get a bit cumbersome. This is especially true as you expand your investments or have various assets and liabilities.

Instead, you can choose to use a free tool like Personal Capital, which easily tracks your net worth and liquid net worth in one place. It aggregates your finances and liabilities into detailed charts and graphs.

Plus, it can help with budgeting, spending, etc. Sign-up and use Personal Capital for free!

How to Increase your Liquid Net Worth

1. Reduce your short-term liabilities

One of the fastest ways to increase your liquid net worth is to pay off some short-term liabilities. This could be a credit card, a car loan or any other short-term debt.

Getting rid of debt will boost your liquid net worth and will reduce the interest you have to pay over time. Consider paying your debt every week rather than every month or double up payments — this will also help reduce your principal over time.

2. Lower expenses

Keep track of your expenses and look for recurring monthly spending that you could be removed or lowered. Cutting down on expenses could give you more money to pay off debt or to acquire liquid assets. It also means that you’ll have more cash, which is the most liquid of all assets.

If you’re struggling to lower expenses, start tracking everything you spend your money on and create a budget. You’ll feel more in control and it’ll be much easier to find any subscriptions you could get rid of or lifestyle adjustments that would increase cash flow.

3. Increase your investment contributions

Contributing more to your stock and bond investments will increase your liquid net worth in the long run.

With compound interest, the total value of your investments will steadily increase and therefore so will your liquid net worth. Increasing your investments is a good way to invest in your future and make the most of your money.

You can also look at alternative investments too like gold, real estate, art, collectibles, etc. Below are some additional investment options you should consider to improve your net worth while diversifying your money.

| Alternative Investing | Outside The Stock Market | Get Started |

|---|---|---|

| Invest In Fine Art ($20 Min.) | Learn More |

| Invest in Real Estate ($500 Min.) | Learn More |

| Invest in Real Estate ($500 Min.) | Learn More |

| Buy Investment Properties (Accredited Only) | Learn More |

| Invest in Gold | Learn More |

4. Minimize non-liquid assets

If you desperately need to increase your liquidity and you’re running out of options, decreasing the amount of non-liquid assets could also be an option.

This may mean selling a property or selling some of the money in your retirement accounts. Even though this will increase your liquid net worth right now, it will affect your overall net worth in the future and your assets will grow at a slower rate.

5. Increase your income

Another important way to increase your liquid net worth is to focus on increasing your income through side-hustles, by negotiating your salary or shifting to a higher-paying career.

Increasing your income will help pay off your debt faster, save more money for your emergency fund, and increase investments. Plus, it could make things easier when it comes to budgeting. In the short term, it will help you increase your liquid net worth.

Frequently Asked Questions

Is a car a liquid asset?

Technically a car is not a liquid asset because you cannot usually sell it immediately for cash. However, most vehicles can still be sold relatively fast and selling your car can be added to your liquid net worth calculation. But it’s important to use a discount percentage when factoring in your car because you will most likely sell it for less than the market value.

Is a 401k considered a liquid asset?

A 401k and IRA accounts are not considered liquid assets until you reach retirement age where you can easily access your investments. The money prior to retirement can be withdrawn before 59.5 years old, however there will be penalties for accessing the money early. Again, you can include it in your net worth calculation, but you’d want to use a discount percent for a more accurate value.

Is a bank account a liquid asset?

Since access to your money in a savings or checking account is immediate, yes your bank account is considered a liquid asset. If you were to need the money in your accounts, you are able to quickly withdraw and use the money. Not all accounts through your bank are as accessible, but a checking and savings account are the most liquid.

Is your house a liquid asset?

Generally, a house is not considered a liquid asset. While it can be included in your net worth as you build equity or own the home completely, getting money from the sale takes time. Most houses that sell can take a few weeks or a month to process before you have access to the cash. Additionally, there are fees, transaction costs, and taxes owed that take away from the amount of money you get from the sale.

Again, you can include it in your liquid net worth calculation, but you should use a discount percent to be more accurate in the result.

Can you have a negative net worth?

It is entirely possible to have a negative net worth and many people that do, will work their way up to a positive one. The reason you may see a negative net worth is because your liabilities are currently much higher than the value of your assets. This usually happens for people early on in their working career as they have student debt or credit card debt and less cash or investments.

What do you think of liquid net worth? Have you calculated yours and are you following it closely? Or does it not concern you too much currently? Let me know in the comments below!