Since I’ve been so enamored with finances and money over the last few years, I’ve started paying more attention to content on these topics.

And over the course of writing about money, I’ve come across various personal finance statistics relating to everything from debt, retirement savings, financial education, and beyond.

Needless to say, there are thousands of interesting financial data and the numbers continue to evolve over the years.

And while more people are becoming more conscious of their money, there are still some scary financial statistics out there.

Eye-Popping Personal Finance Statistics

Doing some digging and research into various finance and money stats, the numbers were shocking, to say the least.

A few numbers were not too surprising to me. But seeing how rough some of these data points were, still puts me back in my seat and probably will for you too.

A few reasons I think America struggles so much financially includes:

- Stagnant wages with increasing expenses (a stat below)

- Taking on too much debt (credit card, loans, housing)

- Not enough financial literacy to keep people out of bad financial situations

- People trying to keep up appearances (Keeping up with the Joneses)

- A heavy consumer mentality over an investor mentality

- The impact of the COVID-19 Pandemic that impacted the economy, businesses, and many families who lost their jobs

Of course, there are A LOT more stats that we could probably add to the list below too. But I wanted to be selective and share some that can put things into perspective.

And unless a lot of the above I mentioned changes in America (although there are some outside forces beyond control), as well as more people taking financial action — these below stats may get worse.

However, not all is lost as there are some positives too. Let’s dive into the personal finance statistics below.

Saving And Budgeting Statistics

Saving money whether for emergencies, investing, or retirement is something every person should strive to improve at.

The challenge is everything is getting more expensive, wages can be stagnant, raising a family is not cheap, interest on loans are high, etc.

Let’s look at some concerning personal finance statistics about saving money and budgeting today.

- 20% of Americans don’t save any of their annual income at all and even those who do save aren’t putting away a lot. (CNBC)

- Over 40% of Americans have less than $10,000 saved for when they retire. (GoBankingRates)

- 56% of millennials don’t have any money saved in a retirement account. The numbers were only a little less bleak for older generations: 39% of both Baby Boomers and Gen-Xers have nothing put away for their golden years. (PurePoint Financial)

- Two-thirds of Americans would struggle to scrounge up $1,000 in an emergency, according to The Associated Press-NORC Center for Public Affairs Research.

- Only 24% of millennials demonstrate basic financial literacy, according to a study from the National Endowment for Financial Education.

- The average American saves less than 5% of his or her disposable income. (LA Times)

- A report in MarketWatch found that half of the American households currently live paycheck to paycheck.

- Of the Americans who have savings accounts, the median savings account balance is $5,200. The average, or mean balance is $33,766.49. (SmartAsset)

- Millennial earnings are low compared to median wages — lower than Gen-Xers or Baby Boomers when they were early in their careers. (Center for Retirement Research)

- CPA financial planners conducted a survey to see what their clients were worried about the most, and a staggering 41% reported that running out of cash was their biggest concern. The survey found that even those with comfortable incomes and net worths still faced significant fears that their coffers would run dry into their twilight years.

- A Gallup poll found only about 1/3 of Americans (32%) maintain a household budget.

- The average American household has $180,040 in savings and retirement accounts. (Magnify Money)

- 18% of workers earning a salary greater than $100,000 are living paycheck to paycheck. (Willis Tower Watson)

- As of January 2020, 41% of Americans would cover a $1,000 car repair or emergency room visit with savings. (Bankrate)

Debt Statistics

Similarly, another issue taking over America and other parts of the world is debt. Between student loans, relying on or overusing credit cards, and high mortgages, there are some intense debt statistics.

Here are a few:

- The Federal Reserve reports on consumer debt each month. Here are historical statistics by month since 1943.

- About 77 million Americans, or 35% of adults with a credit file, have debt in collections reported in their credit files, according to the Urban Institute.

- Nearly one-third of Americans pay the minimum due on their credit card each month, according to FINRA’s National Financial Capability Study.

- Credit card debt comes with a cost. The average household with revolving credit card debt pays $904 in interest annually. (Nerd Wallet)

- But the average American owes over $171,000 on their home, and the average monthly mortgage payment is more than $1,000. (The Motley Fool)

- American household debt rose to $14.3 trillion through the first three months of 2020. (Federal Reserve Bank of NY)

- 54% of student loan holders didn’t actually try to figure out their future monthly payments before taking out any of their loans. (GFLEC)

- A high 44% of American adults — nearly half of us — are relying on an auto loan to pay for our car. (Finder)

- 43% of Americans spend more than they receive each month borrow and use credit cards to finance the shortfall. (Federal Reserve)

- The average credit card debt among Americans increased by 18.5% since 2013. (Federal Reserve Bank of New York)

- Of $1.54 trillion in U.S. student loan debt, women hold nearly two-thirds of the debt. (AAUW)

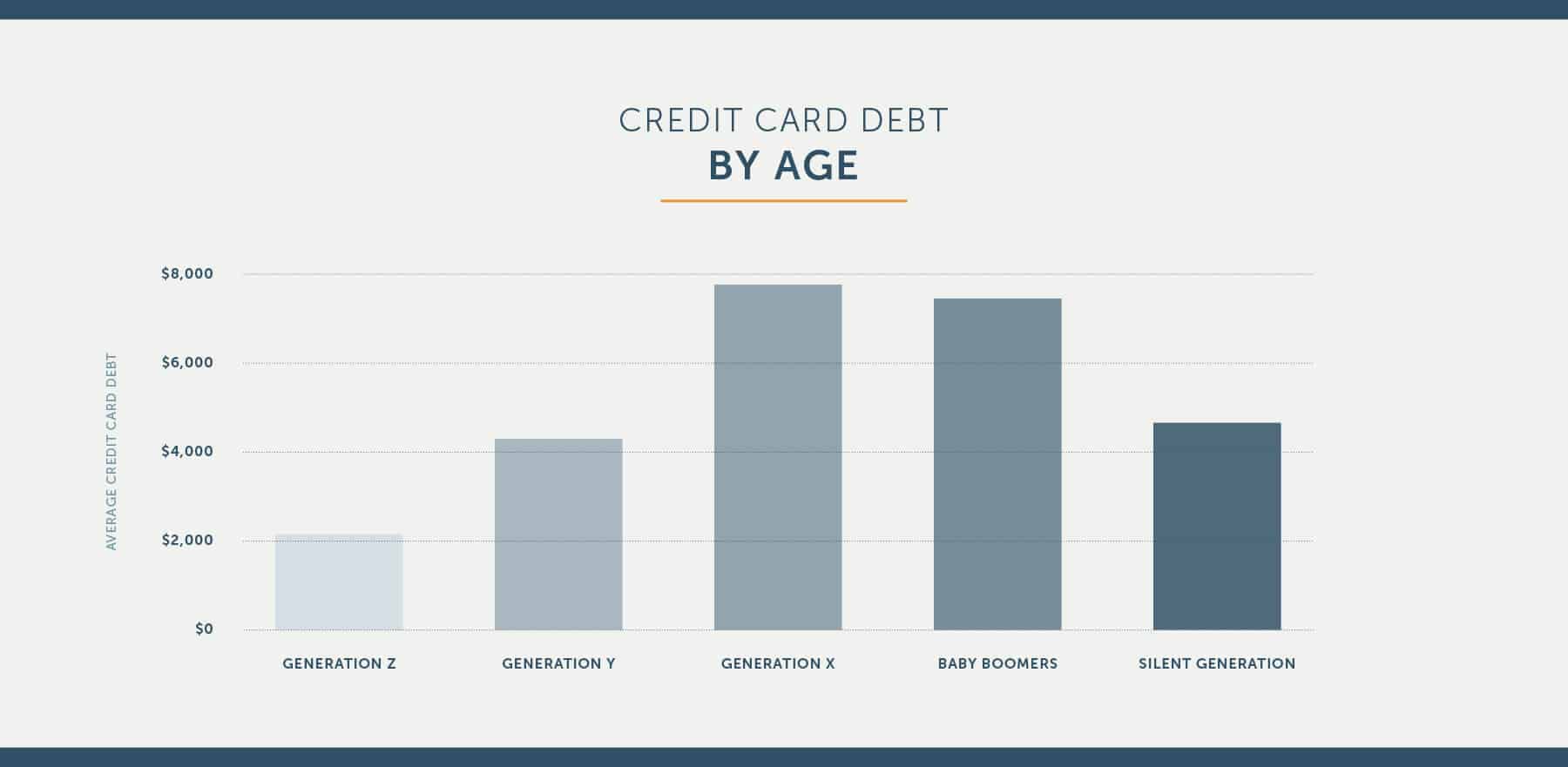

Extra: I’m adding in this interesting chart below, that shows consumer debt among the different generations.

- Generation Z: $2,047 average credit card debt

- Generation Y: $4,315 average credit card debt

- Generation X: $7,750 average credit card debt

- Baby Boomers: $7,550 average credit card debt

- Silent Generation: $4,613 average credit card debt

Financial Literacy Statistics

Being financially literate can make all the difference in your money management and future wealth. Although some school districts are including more money lessons, much of what you should know you’ll need to learn on your own.

- Young adults who get financial education are less likely to carry credit card debt, and more likely to apply to and receive grants and financial aid. (Council for Economic Education)

- One in four parents reported that they never or almost never talk to their kids about household finances. (Guidant)

- About 55% of adults are financially literate in the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom. (Standard & Poor)

Personal Finance Statistics Final Thoughts

Hopefully, the above personal finance statistics served not only as educational, but eye-opening to the current state of our finances.

I think financial literacy is a big missing part of why Americans’ finances are looking rough.

Despite the fact that America is the world’s largest economy, Americans actually rank 14th in financial literacy according to Standard & Poor’s Global Financial Literacy Survey.

Certainly not the worst position to be in, but troubling nonetheless.

And we all have unique stories and situations that put us at different financial levels. The real challenge is what are you doing to break the cycle and not become another concerning finance stat?

America has a lot of work to do to slow down these negative statistics, but a great first step is for us to take more initiative in our finances, money, and budgeting.

What do you think about these personal finance stats about saving money and debt? Is it going to get worse? Are people starting to make changes? Have these numbers affected you to make changes?