Have you ever heard of lazy investing? Whether you are a beginner or have years of experience investing your money, sometimes the lazy approach by building a three-fund portfolio is all you need.

Typically, there is a negative connotation when it comes to being lazy as you always hear that hard work is usually rewarded.

But with investing, many times simplicity and putting in less work pays off much better for you long-term.

And there have been numerous studies and data points that prove less is more when it comes to your investment portfolio.

For anyone investing for retirement or has a long horizon, the Three-Fund Portfolio (3-fund) is a perfect choice and something to consider.

What Is The Three-Fund Portfolio?

The three-fund portfolio is an investment strategy that consists of only three assets, which is usually focused on low-cost index funds or ETFs. it is often referred to as the “lazy portfolio” because it requires little on-going maintenance to generate results.

And when you have a three-fund portfolio, your asset classes will typically contain the following:

- U.S. Stocks

- International Stocks

- U.S. Bonds

While having cash on hand is also typically important with investing too, it’s not included in the overall definition.

The origins of this strategy also came from Vanguard and founder Jack Bogle, which has since gained immense popularity. He also revolutionized investing with Index Funds, which is a top recommendation for this portfolio type.

And the first time I personally heard about this portfolio was reading The Bogleheads’ Guide to Investing, which covers the fundamentals of this investing strategy. I highly recommend reading it!

Who is the three-fund portfolio for?

The three-fund investment portfolio is perfect for anyone who wants to put the least amount of effort into their strategy, but also be diversified. It’s especially a great approach for beginners or those not interested in monitoring their investments daily.

Many various investing strategies exist and can involve tons of work to ensure you aren’t losing money. While some people may want to nerd out and do so, the average person doesn’t want to be bothered with it every day. And that’s perfectly okay and why this lazy portfolio exists!

Advantages of the Three-Fund Portfolio

So as boring as the three-fund portfolio sounds, it also should pique your interest a bit because this simple style actually performs quite well for investors.

Many new investors tend to think about investing in more funds or individual stocks is a good thing. Or that investing in the stock market should be super exciting.

But if you know you are investing for years and want to take advantage of compound interest, it’s better to have a boring asset allocation.

One of my favorite investing quotes by Paul Samuelson says it all:

Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

So what are the advantages of building your three-fund portfolio? There are a few reasons to consider:

1. Diversification

Even in three various index funds, you’ll have plenty of diversification. These index funds hold thousands of assets within them based on the particular rules of your financial institution you choose to invest with.

But you are getting exposure to small, mid, and large companies in various industries and sectors, plus international companies.

Then adding an index fund of bond diversification as well, helps your portfolio have exposure to a lot, with a little.

Lastly, it helps you stay more balanced and protected in stock market corrections or bear markets. Sure, you are never 100% protected, and how balanced you are depending on the percentage of allocation to funds.

But, by not tinkering much and consistently investing in this simple portfolio, you’ll far better perform on the long run.

2. Low cost of investing

When you choose your investments for the three-fund portfolio, you’ll find that they typically have the lowest fees. Thus, helping your investments grow more than other strategies!

Since this strategy calls for investing using index funds, you’ll be selecting funds that have the least expensive funds.

For example, funds from Vanguard, are fractions of a percent when it comes to your costs. I’m talking like 0.02%-0.10%!

This is huge because even though a 1-2% fee doesn’t sound like much when compounded over time it means you are losing thousands and thousands of dollars.

3. Tax efficiency

Typically, you’ll probably be investing in this portfolio style within accounts like a 401k, IRA, or Roth IRA which offers you some tax advantages already.

But a three-fund portfolio can offer a bit more advantages too, especially if you are also investing in a traditional brokerage account as well (which is not tax-sheltered like retirement accounts).

The beauty of choosing index funds is they have low turnover, so there are fewer taxes on capital gains than there would be with standard mutual funds.

And because there is lower maintenance to maintain when it comes to keeping your portfolio balanced, there is less you’ll need to sell and this helps you avoid any capital gains tax.

4. Simple rebalancing and management

One of the maintenance items with investing in the stock market is rebalancing your portfolio. This is where you adjust your portfolio to ensure you are on your target.

For example, if you are 70% stocks, 20% international, and 10% bonds but dividends and share prices change in one, you could have a higher percentage all of a sudden one of your funds. Now you might be off-balance from your initial targeting.

Typically, you’d sell off some amount and move that towards one of your other funds to ensure you are back on your target.

If you were like a day trader or typical investor you may have a handful of funds or tons of individual companies to maintain. This also includes an index fund investor who may be trying to hit every sector individually instead of through the three-fund portfolio.

That can easily get messy, mistakes can be made, and it takes up more time.

Three-Fund Portfolio Performance

What the portfolio type really comes down to is how simple it is to set up, manage, understand, and monitor over time.

But, it’s the three-fund portfolio performance that also matters. As an investor, you want to see results and consistently over time.

After all, the goal is to have your money go to work for you and benefit you in the future at some point in time.

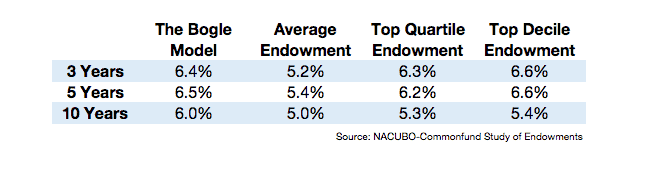

And the results of a three-fund portfolio have continued to shine compared to other portfolios over time. For example, this article discusses the results against over 800 college endowments.

In it, the three-fund portfolio results have beaten them and continued to perform.

Over at PortfolioCharts.com, they went back to 1970 and found the average return for a three-fund Portfolio right around 6%, after accounting for inflation.

So you probably are looking at 6-6.5% and not that’s not overly exciting, right? As it doesn’t sound like much, especially when you some average historical returns much higher.

But for a simple portfolio that needs less worry and attention, this works wonders for you in the long-term. If compound interest teaches us anything, the math of investing is in our favor.

Now I’m going to use 6% in this example below, your three-fund might be slightly higher than this pending your choices (more on that in the next section). But let’s say you only invest $50,000 and nothing more.

At 35 years with 6% compounded, you’d end up with roughly $385,000! Now most people will continue to invest over those years, so your portfolio would be much higher still.

Three-Fund Portfolio Asset Allocation

Okay, so now that you have a pretty good background on this, what are the options when it comes to investing in a three-fund portfolio?

The three funds are just your first step.

In order to really take advantage of this, you need to figure out your three-fund portfolio asset allocation. Meaning, what percentage of your investment money are you going to invest in each of the assets you choose?

There are plenty of variations and what you choose is personal.

Remember, investing is based on your goals, timelines, amount of money you have now, age, etc. So there is no perfect answer, but there are some variations you can consider below.

1. The 80/20

First up is the 80/20 three-fund portfolio, where you are more aggressive on the stock allocation. 80% dedicated to your stock funds and 20% dedicated to the bond fund.

And because international stocks are considered riskier, a common three-fund portfolio with 80/20 allocation could be 60% US stocks, 20% international stocks, 20% bonds.

But there are other variations to consider, like the one from the Bogleheads’ guide, which has a split at 64% U.S. Stocks, 16% International Stocks, and 20% U.S. Bonds.

Again, it’s up to you how you’d like to move forward and you can even set your own percentage allocation if you’d like.

The 20/80

There is also the reverse option, the 20/80 rule where only 20% is going towards stocks and you are heavily focused on bonds instead.

This might be a portfolio for when you are closing in on retirement and want less risk of being in stocks.

2. The 60/40

The other option is the 60/40 three-fund portfolio, which can be allocated as 45% U.S. stocks, 15% International Stocks, 40% U.S. Bonds.

But just like the 80/20 rule, you have various options for how you want to organize your portfolio. For example, you could do 40% US Stocks, 20% International, and 40% Bonds.

3. The Equal Weight

Another example I’ll provide here is the equal weight allocation. In this version, you do not give a percentage preference to either of the three funds.

This would mean you’d have 33% U.S. Stocks, 33% International Stocks, and 33% U.S. Bonds. But you technically will have over 65% in stocks total, so you are favoriting that side over bonds still.

Deciding might be the most challenging aspect of how you diversify your lazy portfolio if you go this route.

I typically have followed a bit more for the aggressive side with 85% Stocks and 15% bonds.

But even famed investors like Warren Buffett generally think people should be very aggressive until they are older, with 90% stocks and 10% bonds.

One option is the percentage of bonds should be your current age. So if you are 30, you want to aim for 30% bonds and then 70% in stocks. For me, it’s a bit too conservative at that age when you have years to go for investing.

Like I said before, what you choose is on your own personal factors.

My plan is to move up 5% in bonds every 10 years until I hit 50 and then start to be more aggressive on bonds from that point on.

This may change as I get older and priorities change, but that’s my own strategy. Also, I’m actually doing a four fund portfolio, which I talk briefly about at the end.

Building Your Three-Fund Portfolio

Hopefully, you are not exhausted yet and still with me! Certainly, a lot of information to absorb here, but overall should be fairly easy to master.

But building your three-fund portfolio really does not take long at all. There are just a few steps to get started outline below.

And if you already have investments and want to switch, you can easily sell your assets and buy the funds you need for this portfolio.

The Steps

First, figure out your asset allocation ahead of time.

Based on the info above and your personal finances, figure out how you’d best like to layout your percentages and funds. It shouldn’t take you too long to figure this out.

Plus if you change your mind when you get started, you can always rebalance it out to your updated view.

Second, pick your financial institution and the matching funds of a three balanced portfolio. For me, I chose Vanguard index funds and will continue to recommend them.

But they are not the only good option out there as you have Charles Schwab, Fidelity, TIAA, and a few others.

But here is a breakdown of the recommend funds based on those institutions:

Build a three-fund portfolio with Vanguard

- U.S. Stocks: Vanguard Total Stock Market Index Fund (VTSAX)

- International Stocks: Vanguard Total International Index Fund (VTIAX)

- Bonds: Vanguard Total Bond Market Index Fund (VBTLX)

Build a three-fund portfolio with Charles Schwab

- U.S. Stocks: Schwab Total Stock Market Index (SWTSX)

- International Stocks: Schwab International Index (SWISX)

- Bonds: Schwab US Aggregate Bond Index Fund (SWAGX)

Build a three-fund portfolio with Fidelity

- U.S. Stocks: Fidelity ZERO Total Market Index Fund (FZROX)

- International Stocks: Fidelity ZERO International Index Fund (FZILX)

- Bonds: Fidelity US Bonds Index Fund (FSITX)

Build a three-fund portfolio with TIAA

TIAA mutual fund participants can use:

- U.S. Stocks: Equity Index (TINRX)

- International Stocks: Emerging Markets Stock Index (TEQKX)

- Bonds: Bond Index Fund (TBILX)

And that’s it! You pick your asset allocation percentages, sign-up with your preferred institution, and invest based on those percentages. From there you can consistently invest. Your last step will be to rebalance as needed to ensure your percentages stay on target.

The Four-Fund Portfolio

In my early days of investing, I started with a target-date fund in my retirement account.

This can also be a great option for you because the balancing in the index fund is done automatically for you. The allocations will update as you get closer to your retirement year.

At first, I mainly chose the target date fund because I didn’t know anything about investing. And later on, when I was learning more, the company 401k I had did not have many great low expense options.

However, as I progressed in my knowledge and wanted a bit more control I graduated to the three-fund portfolio with Vanguard when I had rolled over money to a traditional IRA from previous employers.

But, when I opened my Roth IRA about three years ago, I chose to do a four-fund portfolio instead.

Besides having stocks, international stocks, and bonds, I added a little bit of Vanguard’s REIT for real estate. This still acts like stocks but has recurring dividends to help my portfolio grow.

It certainly has risks and is not going to generate as much wealth building as say owning actual real estate, but it’s an easy additive for me. Plus, I also keep the percentage invested at 10% max at all times to reduce risk.

Final Thoughts

If I were just beginning again today with my long investing horizon, the three-fund portfolio would be my top choice.

And I think for all new investors, it’s the best place to start. It’s easy, simple, and completely effective.

Plus, this approach continues to ensure you are diversified, paying less in fees, and continues to outperform top financial advisors.

What do you think of the three-fund portfolio or “lazy portfolio” as it is sometimes called? Are you investing this way or considering it? Let me know in the comments below!