While learning money skills early in life will be greatly beneficial to you, many times we don’t really pick up on these knowledgeable insights until we reach our 20s.

But even then with personal finances, many will still struggle.

Generally, this is a financial literacy issue, where we aren’t taught finances via our education system and many times people just do not know where to start learning on their own

When you start reaching your mid-20s and beyond, adulthood can creep in quickly with living on your own, getting a job or starting a business, maybe even beginning a family.

And although managing your finances is key, many times it falls behind as you juggle a million different things.

In order to feel more at ease and begin building a comfortable life, you’ll need to master some basic money skills. These will set the foundation in your 20s and can help you be successful throughout your lifetime.

What Are Basic Financial Skills?

Basic financial skills are the essentials you acquire that help you manage your money, grow your wealth, and ensure you are staying out of debt. These standard skills will help you navigate through life with less financial struggles and better prepare you for the real world.

Why are financial skills important?

Why are financial skills important? By developing your financial literacy, you’ll be better equipped with the knowledge and skills to manage money effectively and avoid financial traps. Without dedicating time to developing your money skills, your financial decisions and the actions you take — can lead to a lifetime of struggle.

Money Saving Skills

One of the most important money skills to learn is how you save money. While there is more to building up your net worth and financial future than saving, it’s one of the main pillars to finances. Below are some of the skills to master for saving more money.

1. Create a basic budget

Ah yes, creating a budget. The staple of any personal finance advice you may have ever read or heard. Sometimes that word gets a negative connotation as many think it’s a hardcore dive into every little expense. While you certainly can go that route, you really only need to put a simple overview together.

There are various budgeting strategies you can use, but the important thing is you know your expenses and income.

When this information is written down, you can see where any financial issues might be. Like spending too much on groceries or random non-essentials.

Your budget can help you understand if your living expenses are too much for your income too. And a budget will help you stop living beyond your means and help you control your spending.

2. Calculating your savings rate

Another basic money skill to master is calculating your potential savings rate. Ugh, yes math is back even after you’re done with your formal education!

While the Pythagoras theorem may not be relevant any more, understanding basic addition, subtraction, division, and all that fun stuff still matters with personal finances.

Once you have a budget and a solid understanding of your income and expenses, you can calculate your potential savings rate.

I first look at what my total expenses equal each month. Then subtract that from the total monthly income to understand what I could save.

Example:

- Monthly Income = $3,500

- Expenses Per Month = $1,500

- Leftover = $2,000

So you can safely save $2,000 per month.

And to get your savings rate, you’d do this: $2,000/$3,500*100 = 57% savings rate. Again, this is just a random example to help you calculate.

But you can do this based on your pay period, monthly like the example, or net savings / total income = your personal savings rate.

3. Concept of paying yourself first

The simple concept of paying yourself first is probably the easiest money skill to understand. Typically, most people work for a paycheck, then pay all their necessities and bills, maybe spend some of it, then will try to save.

What happens here is there typically is little to no money left to put into savings.

Paying yourself first, flips this concept by putting money into your savings, an emergency fund, or your investments first before paying your bills. You can set-up automatic amounts each pay period so you don’t have to think about it or remember to manually transfer money.

Start off small and then slowly work your way up to higher percentages. It’s important you start with a budget and calculating your savings rate first, because then you know how much you can afford to pay yourself first.

4. How banks and the account types work

It’s universally understood that banks are how you store your money.

There are tons of financial institutions to choose from, various accounts to open, and different features and fees to learn about. Banking is not overly complicated, but it’s something you want to learn as soon as possible.

For example, there are regular banks, credit unions, and online only banks — each that offer various advantages and accounts that you can use to your advantage. Additionally, you’ll have account options like savings account, checking account, money market accounts, etc.

Learning about your banking options can help ensure your money is safe, earning interest, but also that you aren’t losing money in unnecessary banking or ATM fees.

| Best Online Banks | How to Bank Better | Get Started |

|---|---|---|

| Online Banking Savings Builder | Learn More |

| Online Banking Rewards Checking | Learn More |

| Rewards Checking Financial Tools | Learn More |

| Socially-Conscious Banking Fee-Free ATM | Learn More |

| Savings Account No Minimums | Learn More |

| Online Banking Interest Checking | Learn More |

| Mobile Only Banking Get Paid Early | Learn More |

5. Understanding the basics of frugality

Sometimes when people hear the word “frugal” they automatically assume being cheap or that you are “pinching pennies.” But being frugal is a necessary money skill as it teaches you to value your purchases and what is important to spend money on.

Too often, the word frugal creates this stipulation that you should never spend money and that you live a minimalist lifestyle. And certainly you can if that interests you!

But living frugal doesn’t mean that you can’t go out to eat or buy something you want. Instead, you prioritize what is important to you and cut the spending on things that are not.

You can learn more tips about living frugally here and also your budget will start to help you figure this out as well.

Investing Money Skills

One of the most important money skills to master is the power of investing. It’s the key to help you grow your wealth and be prepared for your future retirement. When you invest money wisely, it also helps you diversify your money and create new opportunities for you and your family.

6. Investing terms

Look, there are plenty of investing terms to know and understand. So many in fact, that it might scare you off.

But don’t worry, if you take learning these slowly and just get started — you’ll be surprised how much you can learn.

But there are two terms I think are valuable to your money skills right now: Compound Interest and Dollar-Cost Averaging.

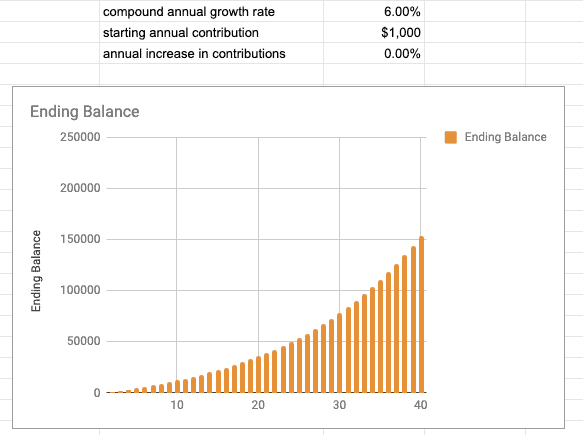

Compound Interest: Compound interest is simply the interest on the principal amount, plus whatever interest has already accrued. The easiest way to understand it is to look at the visual below:

You’ve probably heard many quotes from famed investor Warren Buffett about compound interest, but when you value the power of this, your money will really start to go to work for you.

Dollar-Cost Averaging: Too many new investors try to either time the markets or panic sell when there is market volatility. However, one of the best investment strategies for buy and hold investors is dollar-cost averaging.

This means you’ll invest a fixed dollar amount into a given investment on a regular basis, no matter what the market is doing. By utilizing this strategy, you begin even out the highs and lows of the market.

7. Understanding investment account types

Just like you have various account types and options with banking, so do you with investing. The importance of knowing these will impact your investment income, net worth, and taxes you may owe on any of them.

This means understanding the value of brokerage accounts, 401k accounts, traditional IRA or Roth IRA, money market accounts, and even things like 529 or trusts.

Don’t let all those variations intimidate you, they are easier to understand than you might think. But knowing these investment account types will help you make better investing decisions.

8. Investment assets

Since investing is so important for your finances, you’ll also need to understand the various assets and diversification options you have.

At the basic level that would be stocks, bonds, index funds, and ETFs. But as you begin diversifying, you don’t want to forget about other options outside the stock market like real estate, commodities, art, etc.

Knowing these assets will help you choose how to invest, how you should maintain your investment portfolio, and the impact the assets have on your returns.

Managing Debt Skills

Most likely you probably have some sort of debt. Whether that is credit card debt, student loan debt, or mortgage debt.

If you are currently debt free right now, then congrats! That is by no mean an easy accomplishment.

But for most, debt can be crippling to their finances or hold them back from being able to save and invest. According to ValuePenguin, the average American household debt is $5,700 and the average for balance-carrying households: $9,333!

9. Credit scores

Your credit scores paint the picture of your credit history and tell financial companies how trustworthy you are.

There are many factors into calculating your score, but it can impact the interest rates you get on loans or if you will be approved for apartments, mortgages, cars, or credit cards.

if you want to improve your money skills, then understanding how credit scores work, how to maintain a score, and protecting yourself from identity theft will be crucial.

All these areas will impact your financial life, so the earlier you start to build your score or improve it, the less financial stress you’ll have as you get older.

Use Credit Karma, Credit Sesame, or both to check in your credit scores, monitor debt, and get recommendations to improve your score. Both are free to use and do not impact your score by checking.

10. Debt payoff strategies

If you find yourself in a tricky debt situation, it can be overwhelming to know how to properly pay everything off.

This is especially true if you have multiple loans and various degrees of debt — which is why understanding various debt payoff strategies is important.

Managing and understanding how can drastically improve your personal results and your family’s finances overall as well. But there are quite a few debt strategies you should understand:

- Debt Avalanche

- Debt Snowball

- Balance Transfers

- Debt Consolidation

- Debt Settlement

- Declare Bankruptcy

These all have advantages and disadvantages, plus the choice you make would depend on your personal situation and how extreme your debt might be.

Making Money Skills

While personal finance tips generally focus on saving money, debt management, and investing — often overlooked is the importance of making more money!

After all, you can only cut back spending so far and can only save as much as you currently make.

However, when you have a good financial foundation, making more money will help you reach new levels. But what are the best money skills to help you increase your income?

11. Maximizing your career income

Asking for a raise

The first thing you can do is ask for a raise in your current position. You might get an annual raise pending your job, but many times those are small increments.

However, if you do your research and can prove your value, you can end up getting a raise of 10% or more.

That new percentage can go towards your savings rate, paying debt faster, or towards investments. Learn the basics of asking for a raise early on in your career so you are prepared when the time comes.

Negotiating salary offer

As you move on in your career, you may apply to a completely new company. When you get a potential job offer and salary, you do not necessarily want to take the first proposal.

Usually, hiring managers are going to offer a lower amount to save the company as much money as possible.

However, learning how to negotiate your salary offer can make a big difference in how much money you make. Practice the art of negotiation and learn how to best approach this.

12. Side hustling

Maybe your job is not going to get the raise you want. Or maybe your career path is not as easy to move on up or find a higher paying position. This is understandable and it can be frustrating too.

But thanks to the digital age, there are numerous ways to make money online or on the side. And the popular term “side hustle” has been hard to miss over the last few years.

But what skills do you have? What passions or even current hobbies do you have that could make you money? Learn how to side hustle, manage your time, and impact any income early on.

You don’t need to burn yourself out chasing the dollar, but figuring out an additional income stream is a valuable money skill.

How Can I Improve My Personal Finance Skills?

The best way to improve your personal finance skills is to start reading books, blogs, Reddit personal finance, and listening to podcasts about money. By dedicating just a few short hours a week you’ll be surprised about how much you learn on your own.

The challenging aspect is getting started, but once you find your groove you’ll be a pro at managing your finances.

If you are looking for books to read, I put together this ultimate personal finance book list together that will teach you all the essential money skills.