Whether you actively dedicate time to your finances or not, you have probably heard people discussing investing their emergency fund.

An emergency fund is simply an account for funds put aside in case of an event or finance issue, like unexpected health emergency, job loss, house or car repairs, etc.

Many finance experts also recommend a few months of expenses should be saved. I’ve read anywhere from three months up to a year worth.

While I agree it’s good to have some financial cushion, mostly what is discussed about emergency funds that it’s good to put in your savings.

But if you want to start building real wealth and reach higher savings goals, you’ll need to put that money to work.

Your Savings Account and Emergency Fund

If you do any searches about what to do with an emergency fund, most publications or experts will recommend how much to save and that you need to put it aside.

While I will agree you want to have access to some decent cash reserves, leaving this money off to the side can be a mistake.

If you want to grow your net worth, build wealth, and compound your cash, you’ll want to start investing your emergency fund.

Now, we’ll get more into that a bit further down.

But why shouldn’t you just leave this money in a savings account?

I’d like to start off that there is nothing wrong with having a savings account or keeping cash reserves in it. I have a percentage of my own money in set aside for immediate needs, but the bulk of my savings is not.

Why?

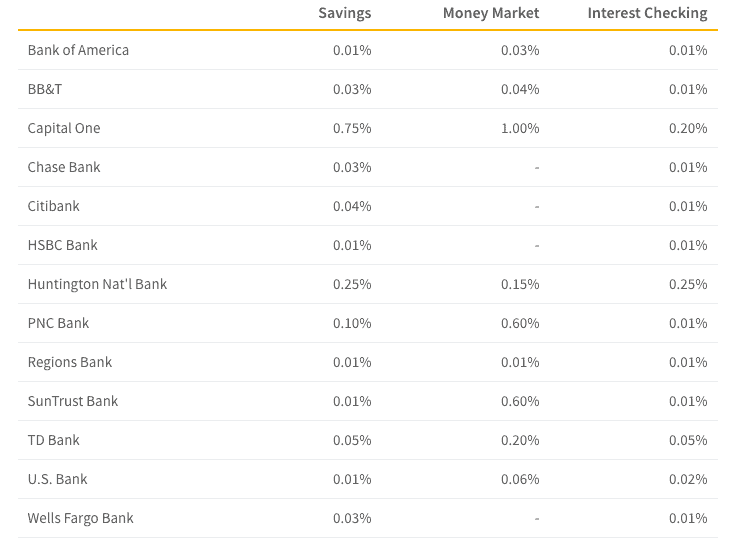

Well, the problem is the interest rate you get on a savings accounts is pretty sad. Some online banks can maybe get you 1-2% returns but the vast majority of banks will be a fraction of 1%.

Check out these images from ValuePenguin below to see how low the interest rates can be. My banks’ interest is even lower, but they provide other benefits as a credit union, so I let this slide.

Not a pretty sight.

Now, if you looked at investing your emergency fund into the stock market and index funds, you can see an average closer to 6%-8% and even higher pending how the market is doing.

Now there are some risks with investing your emergency fund, which is why this next section exists!

Is Investing Your Emergency Fund A Good Idea?

Before you consider investing your emergency fund into the stock market, you should be able to check off a few items first.

As I’ve mentioned earlier, I think having some money in a savings account for quick access is still smart (I do this). Never go all in with your savings.

But I also believe if you fit the criteria below, it’s time to put a portion of your emergency fund to work by investing it.

1. Firm understanding of investing basics

I don’t recommend you just jump into investing your emergency fund if you do not have a basic understanding of investing.

Develop a strong knowledge of index funds, bonds, individual stocks, and investment accounts would be key.

It’s not too hard to learn as there are plenty of online resources to help you. If anything, consult a financial advisor, your accountant, or someone you trust that understands finances quite well.

And be careful about any get rich quick schemes on stocks that you might read or hear about. The goal with investing your emergency fund is to not expose your cash to an insane amount of risk.

2. Stable income and job

A good reason to have an emergency fund is if you were to lose your job or if your income varies (freelance or you work for yourself).

But if you feel you’re in a great spot, your company is doing well, your income is stable, or your career is in high demand — then you might want to consider investing your emergency fund.

It took me a few years to consider investing part of my emergency fund, until I worked on my career and had a stable salary.

But once I felt more job security, I started to invest more of my emergency fund.

3. You have a side hustle

Before I had started to really invest my emergency fund, I was doing a lot of side jobs and freelance work too.

This helped build a decent amount of savings and gave me a financial cushion in case of a job loss on the full-time gig.

Currently, Invested Wallet is my side gig and it makes me some money right now. But it helps to have another stream of income besides your full-time job.

4. You aren’t living paycheck to paycheck

Basically, this also goes with having a stable job or side hustle. But if you are not living paycheck to paycheck then it may be a good time to invest.

And it’s okay if you are currently stuck paycheck to paycheck, I was for almost five years after graduating college and definitely could not invest my savings.

The risk was not worth it, especially when I needed almost every dollar to scrape by for the month.

But once you are out of that rhythm and are not worried about having enough money for life essentials, then it may be time you look at investing your emergency fund.

5. Good credit limits

While I don’t recommend going into credit card debt, having good credit limits on your card can give you peace of mind.

Meaning, if you get in a bind or an emergency comes up, you have a credit card to cover the costs. If you have a decent saved and invested, you can probably ensure you pay off the balance quickly.

Just be careful not to rely too much on your credit card. You may end up having to sell your emergency fund investments or going into debt that you can’t actually pay more than the minimum.

Where Should I Invest My Emergency Fund?

Now that you know the criteria you should meet before considering investing your emergency fund, where might you invest that money?

You want to choose the right investment account and the financial company that suits your needs best.

Here are some solid options for you pending how and what you’ll invest in:

Generally, index funds or ETFs will be great options for investing your emergency fund.

But it’s important to know that if you use a brokerage account for investing, you may have taxes to pay at the end of the year on any dividends or capital gains.

Brokerage accounts are not sheltered like an IRA or Roth IRA. But there are some tax-advantage funds that can help limit your taxes.

How I Invest My Emergency Fund

So now that we dove into investing your emergency fund, I figured I’d break down slightly how I invest my own.

I use Vanguard for everything because they have some of the best index funds and low fees. You can use whatever you prefer though (see list of some options above).

So here is my breakdown from each paycheck:

15% goes to my savings account from each paycheck:

This is for an immediate need of cash and quick access in my bank.

While you can sell funds that are invested and transfer back via a brokerage account, it can still take 2-3 days to transfer back.

If you need quick cash for something, this can put you on hold. Once I built up my emergency fund to six-months, I only started putting 15% each pay period towards it.

30% goes into my Vanguard brokerage account in a fund called VMFXX:

The interest isn’t much higher than a bank, but I still get a better monthly return.

From that, I have this money being split into a tax-managed index fund called Vanguard Tax-Managed Balanced Fund Admiral Shares.

The tax-managed index fund VTMFX is for 7-8% growth with lower risk and more tax efficient on the gains.

The fund is a minimum of $10,000 but there are other funds and ETFs that are good to look into as well that won’t require that high of an investment.

These index funds can still be sold fairly quickly if needed, with minor tax implications like if you pulled from a 401k or IRA.

Related: Looking for some of the best Vanguard funds for taxable accounts? This article is for you.

The remaining 55%:

My other income goes to my Roth IRA since my company does not offer a 401k currently, checking account for bills and a little bit of cushioning for spending, and other investments like real estate crowdfunding.

Investing Your Emergency Fund Is Personal

Investing your emergency fund is not something you should take lightly and is a personal choice. While I think it is a great idea, granted you meet some of the criteria above, it still might not be right for you.

There are numerous factors you must consider first before exposing any of your savings to some risk. The big one being, you must build a financial cushion that does stay in your savings account.

That said, I think it is perfectly okay to invest your emergency fund money to help reach specific financial goals.

But before you do, ensure you meet some of the criteria above, don’t overexpose yourself to too much risk, and take your time putting your emergency fund money to work.

So now the question is, are you considering investing your emergency fund? Are you investing that money currently? Let me know in the comments below!