While I did not want to sound like a cliche blog writing about financial resolutions right now, here we are!

All joking aside, I think it is appropriate to start setting some things in motion for the upcoming new year.

However, I wanted to include more than just the generic, “Hey, save more money!”

Pretty obvious that is what the majority of people want to do already and is a common resolution to have. Nothing wrong with having that goal, it’s certainly one I have for myself each year too.

Instead, I’ve tried to discuss some financial resolutions that are important to start off a new year with, but also ones that offer insight to help get you started.

1. Schedule An Hour A Week To Your Finances

First up on some of the best financial resolutions is to schedule at least one hour a week to your finances.

That shouldn’t sound painful and it leaves you plenty of time in your busy week to take care of family, school work, life events, and Netflix.

It doesn’t matter what you focus on week to week, just something related your personal finances and financial knowledge. It could be budgeting, tracking your spending, investing, reading a financial book, etc.

Doing those things each week for one hour can make a huge difference in your financial literacy, as well as in your future financial decisions and gains.

I started in 2014, reading 1-2 hours each week something finance related and it made a major impact to where I am today.

Don’t even wait until the middle of the new year, start as soon as possible.

2. Put A Plan In Place to Tackle debt (And Actually Stick To It)

Putting a plan in place to tackle any debt is pretty common and a popular financial resolution for many.

But the twist is, plenty of people do not stick to their plan and even worse, end up racking up additional debt.

The real way to get ahead is to get a plan going right now and activate as soon as possible. But, make adjustments where need in order to pay more on your debt.

If you are paying bare minimums on credit cards, the interest may get you and you end wasting more money in the long run.

Break the spending money cycle, put a plan down on paper, and execute.

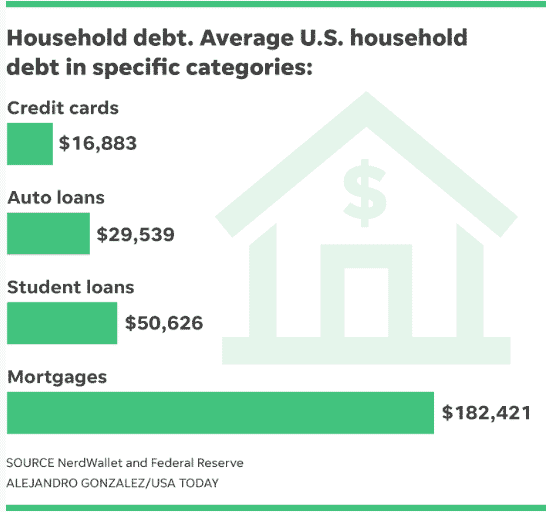

Note: According to USA Today, here’s how much debt the average U.S. household owes in credit cards, auto loans, student loans, and mortgages.

3. Learn About New Ways to Diversify Your Money

We basically all know that the stock market exists and that you can invest in stocks and bonds.

Related: Here on the top investing tips you should know before putting your money to work.

The stock market is a great place for you to start investing some money in your retirement accounts or brokerage account.

But should you place all your money in those locations? No.

I think it is the best place for someone new to start, learn, and test.

But it’s important to understand some basics about diversifying your cash and other ways to put your money to work.

For example, investing in real estate (or real estate crowdfunding), investing in art, investing in a business, investing in commodities (gold, silver), etc.

While you shouldn’t blindly start throwing money at these assets, take some time to learn the importance of diversification.

4. Start to Track Your Net Worth

I actually ignored this for a few years after learning more about finances and investing. Not sure if I was subconsciously afraid to look at it or didn’t’ think it was that important.

Regardless, for the last few years, I’ve been pretty actively keeping tabs on my net worth. Now, a lot of people may use spreadsheets, but I chose Personal Capital.

I heard a lot about Personal Capital and people seemed to really trust their product. Plus, it’s free to use unless you need some of their premium features.

I don’t log in every day, as that can drive you nuts (just like watching the stock market every day). But it gives me valuable insight into my spending, how my net worth has fluctuated, and more.

Don’t be afraid of your net worth, embrace whatever the number is and start improving it.

5. Review Your Last Year (Mistakes & Financial wins)

Before starting your new year off and working on most financial resolutions, you should spend some time reviewing the last year.

Even if you were not paying much attention to your finances, this is a great way to get started.

You may find some amazing opportunities that don’t require much effort to fix. You may even have some nice financial wins without even realizing it too.

But, you should be prepared to cringe too, as you may not have realized how bad your spending, budget, or money problems were or are currently.

Don’t be discouraged! This is a golden opportunity to take the right steps to correct those issues.

I’m making this a priority for myself too where I reviewing my savings, my Roth IRA contributions, my spending, etc. It will only make my following year results stronger.

6. Start a Side Hustle for Additional Income

While you can save money monthly and have all your bills paid with one income, having multiple streams of money coming in can make a big difference.

I know, I know. It’s not always easy, especially if you have a full-time job and a family to spend time with and take care of currently.

But even if that is the case, you can start off small and find things that won’t take much time to start.

However, if you are looking for a financial asset in the future or full-time income generating side hustle, it will take some time to work on.

In the past, I’ve done some side hustles like:

- Shoveling snow for neighbors

- Cutting lawns and other yard work

- Starting a blog

- Freelancing

Having an extra few hundred a month, or even a few thousand a month is possible and can really help you save and tackle any debt faster. You might even be surprised that your hobbies can make money too.

7. Ask For A Raise

Probably not the most valuable of the financial resolutions on this list, but yet something still pretty critical.

If you work full-time, have a good work track record, and have not gotten a raise in quite a long time, you need to ask for it.

Simple, right? Well, not really.

It can be scary to ask for a raise but it is crucial in making more money and helping your finances.

Put a plan in place to ask for one, be prepared to talk about what you’ve done (big wins, extra work, never late, etc.) — this is where you need to sell yourself to why you deserve a raise.

Also, research your industry and your job title. Look into average salaries, low end, high end, etc. This can formulate the type of money you should be looking for and where you currently stack up.

Unfortunately, many companies and managers may not be very accommodating or might even be dismissive. That negative atmosphere will keep you stuck and I’d recommend finding a new gig.

However, many times managers will be open to rewarding your work and are quite receptive to your ask for a raise. You won’t know unless you ask.

8. Get Any Affairs In Order (Life Insurance, College Savings, HSA)

Too many times we put certain financial affairs off because:

- We have busy family lives

- We don’t know where to start

- We keep putting it off because it’s not exciting

- We don’t want to think about future situations

Regardless if any the above is true for you, ensure one of your financial resolutions is to get your financial affairs in order.

Whether that is life insurance, getting a college savings account started for your kids, contributing to your health savings account, starting a 401k, etc.

Stop delaying, because something might happen unexpectedly or you lose out on a better financial situation and it’s too late.

Start off your year strong by getting your affairs in order.

What are your money resolutions for the new year? What are you going to do to ensure you hit those goals? Let me know in the comments below!