While I like to write about personal finance, financial freedom, etc. I also like and will be writing more about investing too.

After all, I did name this website Invested Wallet (;

Since September recently passed, I thought it was fitting to write about my recent four year anniversary of investing in the stock market on my own.

Yes, I completely self-manage my Vanguard accounts and no, prior to September 2014 I knew zip about stock investing. Notta. Zilch.

My goal with this website has been to show the everyday person, that investing money and understanding the stock market is easier than you think.

A big misconception about understanding the stock market is that it is too complicated or just for rich people.

Nope! Because if my previous non-understanding and no-money-having background can do it, you certainly can as well.

However, you do need patience, a willingness to learn and to be cautious with how you invest your money until you feel more comfortable. Even then, you might want to still consult with an expert.

Where it all began…

I’m not going to go crazy with my background story here, if you are interested I recommend going to my Start Here page.

But September 2014 I decided to open a Vanguard brokerage account to start putting some money there (better returns than my savings account and eventually to invest), with the goal of self-managing my retirement accounts there as well.

The idea sparked that summer with a buddy of mine who recommended I do this and he’d help set up the account with me. After that, it was on me to learn more.

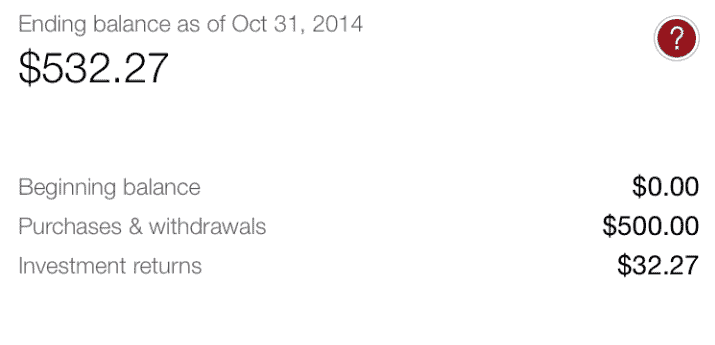

Here’s a screenshot of my September – October 2014 account. Whopping $500, but hey I made $32 in returns! I’m rich!

Now, I did have a 401k with the company I was working with at the time. It had about $4,000 in it, but I had no clue what it was invested in. Nor was I even contributing enough to get the full company match. Oompf.

But I just didn’t understand it or take the time to care.

All I knew was saving some money for retirement was good to do and that’s that. Sometimes I’d like to go back to that time period and give my younger self a good smack.

However, that is very common among my millennial generation and younger, so really I was just the average person.

Yet, through reading these finance and money books, reading online blogs, researching funds, and being patient, my knowledge and money invested have started to take off.

And no, before you think it. I’m not a millionaire nor have some massive 6-figure account. And, we, of course, have been in a great economy/bull market that has kept my returns pretty healthy.

But I’d say I’ve done pretty well weathering some of the corrections the last few years and choosing the right funds to keep the returns flowing. I’m looking forward to being tested in a bear market, which I’m sure will be coming soon.

But hey, check out my investment return percentages, not too shabby for self-managing and not knowing jack in 2014, eh?

Retirement returns since inception of 2014 – present

Retirement returns in 1 year, Oct 2017-Present

The Lessons I Learned in Four Years of Stock Investing

Needless to say, I learned a lot of lessons over the last couple of years. But instead of listing them all, I want to share some of the most important ones that affected my journey.

I think these will be valuable for any beginner or those thinking about investing, but are afraid to start.

Anybody can learn the stock market – Yes, ANYBODY

Despite some sad stats, like: “Only half of Americans actually, own stocks. And the wealthiest among us own 81% of their value” via MarketWatch, you don’t need to be rich to invest in stocks.

I had less than $1,000 saved and about $4,000 in a company 401k. I also wasn’t even making $40,000 pre-tax in 2014.

With no background in investing, I had to learn and set time aside to invest. In a less than a year I was fairly confident but by no means a pro.

Taking the first steps is the hardest, but it gets easier

With any new initiative, especially one that involves your money, taking the first steps is the hardest.

There is a lot of information out there. Where do you start? How do you start? None of this makes sense!

Trust me, I had all those same thoughts. And while my family was encouraging, they still were concerned. When you have no background in the stock market and you start talking about putting money in there, their protective nature comes out.

But that’s why you create a plan, do your homework, and start off gradually.

Reading books is crucial, even after knowing a lot

As I mentioned in the intro, reading books was essential, necessary, and crucial to my investing foundation. There is a lot of noise out there online and with books.

The key is knowing your investing goals and why you are doing it. This can help you find the right books and material to keep you grounded.

If you see any get-rich-quick sounding books or topics, avoid. Stock investing is a long-game strategy. Yes, you can make some good money quickly. But fast money brings faster downfalls with investing.

These finance and money books are the top ones I recommend diving into that will get you on the right investing and finance path.

Dollar-Cost Averaging will be your good friend

For anyone new to stock investing, you should be focused on a few things.

- Individual stock picking should be ignored (Later down the line if you’d like to test the waters go for it, even then be careful)

- ETFs and Index Funds are your best route to start

- Dollar-Cost Averaging should be your best friend

For the second bullet, feel free to look those up. But, the third bullet I’ll cover quickly.

Dollar-cost averaging is an investment technique of buying shares of a particular investment on a regular schedule, regardless of the actual share price. Meaning, do not worry if the price is low one month or high the next, stick to the same investing schedule.

Of course, there is some more too it. But I recommend reading this about it and fully understand it.

Understand how to find the fees involved in stocks and funds

Something that a beginner might miss, is the actual fees in trading. purchasing stocks and funds, and account fees.

It’s amazing how many financial institutions are out there charging 1-3% account fees or “maintenance fees” as they might call it.

In reality, it’s a rip-off and can cost you thousands and thousands of future investment returns. Let’s say you average 7% returns between a diversified portfolio where you have 3 mutual funds.

Well, yearly fees on each fund are 1.4%, that means 4.2% of your returns is now going to the institutions’ pockets so now you are left with a measly 2.8% investment return. This happens ALL THE TIME TO PEOPLE.

Heck, even my last company 401k had high fees and even rollover fees! Luckily I caught that from the start and chose only 2 funds to keep my fees as low as possible.

Choose a platform with low fees like Vanguard and look at expense ratios on funds or ETFs, you can save yourself a lot of money.

Down markets can be scary, but DON’T PANIC SELL

I usually roll my eyes because everytime a correction or loss happens, an article pops up about don’t panic. But it’s really true.

A few times I got scared in the beginning when some corrections came through and sold. D’oh! Guess what? Within a few weeks, it bounced back and has been growing ever since.

If I held it and kept dollar-cost averaging, I would be in much better shape.

It may seem like the world is ending, but if this invested money is for the future or retirement, you should not worry.

The world is not ending and if it is, your money won’t help you anyway.

Don’t obsess over your investments

Oh, yes. This one. I think the first six months I looked almost every day for a few minutes. Don’t do that.

You’ll drive yourself crazy, causing you to either sell, buy something stupid, or change funds because it doesn’t look like it is going your way.

In the beginning, especially if you struggle with self-control, avoid checking in every day. Don’t download the financial services app on your phone and delete any stock market apps too.

Now, I look a few times a week but I’ve learned to control more of my urges and avoid making rash investing decisions.

If you made it this far, thanks for reading! Or if you just scrolled to the bottom that’s fine too ?

Extra! Blogging can be a great side hustle to build passive income and be a financial asset for you in the future. And starting a WordPress blog is easier than you think. Learn how to start your own WordPress blog and grow it to start building passive income.