If you are active in your personal finances, then you probably have heard of Personal Capital.

But, if you are new and just getting started, then this financial tool might be not be familiar to you.

Either way, I’m going to cover exactly what Personal Capital is, how it works to your financial advantage, and some pros and cons of the platform.

By the end of this post, you’ll have a strong understanding of this product and if it is the right option for you.

Now let’s jump in!

Quick Review: In short, I RECOMMEND Personal Capital to help monitor your investments, spending, and net worth, giving it a 8.5/10 score. You can create your free account to begin visualizing your finances in one location.

What is Personal Capital?

Personal Capital is a financial wealth management tool that gives you a complete overview of your money. The platform helps you track areas of your finances like investments, cash flow, budget, and net worth in one location.

You can login via their desktop platform or use the Personal Capital app for on-the-go discovery and financial monitoring.

Now, you can do these financial calculations yourself and create spreadsheets, but Personal Capital takes the entire hassle out of doing that.

The platform will provide recommendations, find hidden fees, give investment analysis, and show data visualizations of charts and reports that give you insight to where you are in your financial journey.

These numbers are done by connecting bank accounts, credit cards, and investment accounts so all the data is aggregated together.

Woah, hold up. What about the security of all this account linking?

I work in tech and security is big concern for me too.

Although I do not understand all the in’s and out’s, their security information covers a lot and ensures the best quality.

They encrypt your information with military grade key factors, tight regulations so no one accesses your credentials, and more. You can read more about their security features here.

And just how popular and trusted is Personal Capital? As of July 2019, the company has $10 Billion in asset management and over 2 million users managing their wealth via their platform. Some solid numbers.

Interested in testing it out for yourself? Start Your Free Account

Personal Capital Financial Tools

Since we covered a bit about what Personal Capital is, I wanted to share some of the specific tools their platform features. These are also free to use with your account, which is pretty sweet and probably the more popular draw to the software.

Retirement Planner – Ensure you are on track with your retirement investment accounts and see how they are growing all in one place. They also have a fee analyzer, which can show hidden fees and provide some basic recommendations to maximize your returns.

Net Worth Calculator – One area I mainly use Personal Capital for is to do all the calculations of my assets and liabilities. Monitoring your net worth is easy with the platform and it then breaks it down in cool visuals and data charts.

Budgeting – Although Personal Capital is not known for their budgeting features, they do have some included that can help your spending and saving. For instance, you can track and see where your money is going to particular merchants. Plus, you can set up some spending targets, to help you stay on track.

Personal Capital Wealth Management Services

Besides the free tools that are good to analyze your financial life, they also offer some wealth management services.

Investment Services: Investors with up to $200,000 in investments gain access to personal portfolio strategies, tax planning, and 401k advice, and direct options to talk to financial advisors. With this tier you can get 24/7 support, all the days of the week.

Wealth Management: You get everything from the Investment Services tier, but this one comes with two dedicated financial advisors to you specifically. However, your assets must be in the $200k-$1M range.

Private Client: The highest tier includes Certified Financial Planners™, investment committees, estate and legacy portfolios, private banking services, and a bit more. But these cool benefits are strictly available to investors with $1M+ in assets.

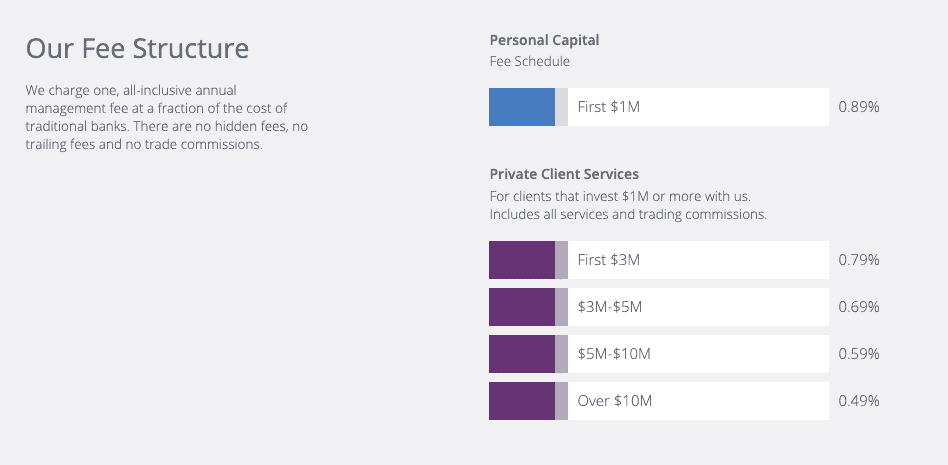

The Fees for Wealth Management Services

If you do decide to take advantage of any of their wealth management services, you should understand the fees involved. Your goal with any investing or financial services is to minimize your fees.

You may see fees like 1-1.5% — and think — that’s not much. But over time and compounded, it can take thousands away from your nest-egg.

Personal Capital’s fees are pretty straightforward though, ranging from 0.49%-0.89%, with no hidden fees and no trade commissions.

But remember, you need an account minimum of $100,000 for those services. Additionally, while their fees are pretty low, there are robo-advisors out there that are cheaper.

However, you do have access to some great experts, which may negate to you that cost if your assets fit their ranges of their wealth services.

Something to think about, but ultimately it is your decision if you do decide to take advantage of this feature.

Personal Capital Pros And Cons

With any financial software, there are of course both pros and cons.

I’ve used Personal Capital for over a year and have recommended others use it as well. I also always try to be honest with my opinions and there are also some cons too (but no platform is going to be perfect).

But first, let’s get into the goods of the platform.

Personal Capital Pros

Firstly, the fact that this platform is free to sign up and you can use many of the main features is awesome.

So what are the general pros of Personal Capital?

- Free to use many of the financial tools

- 401(k), IRA, 529 plan, and trusts support

- Automatic rebalancing of accounts

- Tax-loss harvesting help

- Access to certified financial advisors and planners by phone, email, live chat, or web conference 24/7

- Some budgeting and cash flow tools

- Investment simulators and calculators

- Added a high-yield online savings account with 2.30% APY that’s FDIC insured

Personal Capital Cons

As I mentioned in the beginning of this section, no software platform is perfect and there will always be some cons too.

So what are the cons of Personal Capital?

- Higher management fees for paid services compared to some other platforms

- Investing management, must have $100k minimum for access to those services, which alienates smaller accounts

- Large account minimum needed for Wealth Management ($200k-1 million)

- Limited budgeting capabilities in the platform

Should You Use Personal Capital?

If you are looking for wealth management, discovering net worth updates, along with your monitoring your investments, Personal Capital can be a great tool for your financial arsenal.

The free tools are easy to use and having all the data visualizations and recommendations in one place is something you can’t beat.

However, if you are looking strictly for budgeting aspects, I’d look elsewhere as there are limitations with Personal Capital.

Additionally, the fees on some of the services while pretty good, are still quite higher than other robo-advisors. But, it ultimately is your decision based on their services and your goals if it’s worth paying for.

If anything, I would consider taking advantage of their tools and services to see how you like it. After all, there are tons of free items to use and you can also delete your account later.

Want to get started? Try Personal Capital For Free

Bonus: Recently, Personal Capital got into the high-yield savings account game. This seems to be a newer movement that is really catching on. I’m not too familiar with their savings account, but it is FDIC insured (always good), 2.30% APY, no fees, and no minimums — which is also solid. There are a few other platforms that have slightly higher interest, but if you already user Personal Capital for everything else, this might be a great option for you.

FAQs

Looking for some quick common frequently asked questions about Personal Capital? Below are some short answers to the common questions people have.

What is Personal Capital?

Personal Capital is a financial wealth management tool that gives you a complete overview of your money. The platform helps you track areas of your finances like your current investments, cash flow, budget, and net worth.

Is Personal Capital really free?

Yes, Personal Capital is free to use. However, they do have a fee-based model for their wealth management services. But, you do not have to ever use this service and can stick with their free applications to monitor your net worth, spending, and investment account performance.

Is it safe to use Personal Capital?

Yes, Personal Capital is safe to use. No individual at the company has access to your credentials, the company does not sell your data to third-parties, and the company uses a strong encryption and web certifications to protect your information.

How does Personal Capital make Money?

Personal Capital does not make money on their free applications. Instead, they generate their revenue from an annual fee on the assets they manage under their wealth management services. No hidden fees, no trailing fees and no trade commissions.

What do you think of Personal Capital? Have you used it? Do you like it or dislike it? Let me know in the comments below!