Where should you invest your money?

A question you have probably asked yourself as you start accumulating more money.

Unfortunately, most people get trapped in the mindset of putting money in their checking or savings account and letting it sit.

While that is great for building an emergency fund, at a certain point you want to put your money to work.

That’s where diversifying and investing will become key.

Investing In A Savings Account

Sure, your savings account probably gets you some interest, but if you are anything like my one bank, it’s almost nothing!

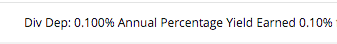

Check out my recent bank screenshot, 0.1% interest baby! Time to retire!

Not everyone’s bank pays as low as mine does on interest, some might be closer to 1%.

But according to CNN Money, “The average savings account has a measly 0.06% APY (annual percentage yield, or interest), and many of the nation’s biggest banks pay rates as low as 0.01%.”

Yikes!

Now, of course, I still recommend putting some percentage of your money into a savings account each pay, each month, or however you want to do it. This grants you quick access to money for unexpected emergencies or bills.

Plus you have some high-yield online bank accounts that can be great options for your money.

But if you really want to put your money to work and generate more income, you have to consider investing in places where you can get a much higher return on your money.

Of course, there are always risks with investing so always do your research and don’t go “all in” on any particular investment.

But once you are feeling more comfortable, you’re looking to generate more money, have a stable income, and are more interested in building wealth, the below places might be a great place to start.

These are in no particular order.

Additionally, I’ll share where I currently have my money and my plans for the near future.

1. Stock Market

The obvious and most common place to invest your money is the stock market. This can include a brokerage account, 401k’s, IRA’s, and individual stocks of companies.

Let’s break these down a bit further.

Brokerage Account

A brokerage account is an arrangement between you ( the investor) and a licensed brokerage firm permitting the investor to deposit funds with the firm and place stock/bond orders through that brokerage.

Many people also invest in a money market fund, like Vanguard for example. It acts just like your savings account. Except, it takes a few days to transfer back to your bank if you need it right away (hence still putting money in your savings account).

But if you are looking to gain a bit more interest or considering investing in tax-advantaged index funds to build higher returns, this can be a great place to start putting your money.

401ks & IRA’s

This can be your company plan, your individual 401k if you are self-employed, traditional IRA or Roth IRA. These each have slightly different caveats, but all are for your future retirement. Certainly, one of the best things you can do is have a plan for retirement and invest a percentage of money into a retirement account.

I’m not going into heavy detail about what each one is and the differences as there is a ton of information online. However, just note it’s important to start earning 6-8% on your money for your future.

Individual Stocks

I don’t think most people should invest in individual stocks and if you are hoping to get rich quick by doing this it will typically spell disaster for you. Now I’m not completely against picking a few, but only if you are willing to lose that money and will be okay financially if you do.

For me, this means no more than 1-2% of my total available cash. If l lose it, I’ll still be good and can eat, pay rent, etc.

Now, for those newly into investing, stay away from individual stock picking. Instead, focus on low expense index funds which diversify your cash and is less of a headache for you.

529 Plan

If you are starting your family and gearing up to have kids, another great option to invest some money is a 529 Plan. This is simply is a tax-advantaged savings plan created to encourage saving for future education costs. There are of course some rules and regulations, but if you are interested I’d recommend reading this.

2. Real Estate – Rental Properties

I’ve read a few money books over the years, and you know what all of them have in common at some point?

They each have brought up investing in property as an important means of building wealth.

Real estate investing, especially for rental properties can be a bit overwhelming for a newbie, but can also be an incredible wealth builder for your future.

While the real estate market may have a recession every now and then with recovery, value for property typically goes up.

However, rental properties can be a lot of work and time-consuming. Yet you can make money on renting out rooms or rehabbing and flip the property.

If you are interested in real estate, I recommend reading this massive book called The Millionaire Real Estate Investor, by Gary Keller. It’s a giant book, but if you are serious about real estate you need this in your collection.

3. Real Estate Crowdfunding

For those of us who either don’t have enough knowledge or capital to get into actual real estate yet, real estate crowdfunding sites are a nice option.

It simply allows you to invest in real estate properties where investors are paid out a return once the project is complete or sold. Investors can also get paid out monthly dividends as well, it all depends on the loans you get involved with.

Typically, this was for accredited investors only but that has changed.

More platforms have come out that give others a chance to diversify their wealth. The three I’ve done research on, am in on myself, and have friends that invest include:

Groundfloor – Recently opened their loans to all states and the platform I’m currently involved with. I have enjoyed their platform so far and is a great way to get involved in real estate.

Fundrise – One of the more popular names in this group, but one I decided to not invest with right now. I have some friends investing here too and have been fairly happy with the returns.

DiversyFund – DiversyFund is an online platform that allows you to invest in commercial real estate funds with as little as $500. Relatively new to the game but they are also the only no-fee platform currently!

If you are looking for more in-depth about real estate crowdfunding, I recommend reading this article.

4. Invest in Art

Investing in actual art can be a tricky one, but something people have been interested in doing so for years.

The reason it is challenging is, investing in current artists can be hard as you really don’t know how they will take off in the near future. People’s taste and popularity of artists can fade or change.

Of course, well-known names like Monet, Van Gogh, and Warhol would cost you millions to buy yourself, not likely good odds for you.

The best you can do is choose art you really love, see value in, and to know a bit about the artist you are considering buying.

Yet, just like crowdfunding for real estate, someone founded a really cool idea – allowing you to purchase and trade shares using the blockchain on famous artworks. It’s extremely new and the business itself is in the process of being approved by the SEC.

The company is called Masterworks and I think they are on to something big. Again, this is still a risky venture and because it’s new, I would never recommend anyone throwing tons of money at it right away.

But for as little as few hundred bucks, you could own a few shares of an Andy Warhol piece or Claude Monet.

I currently do not have any money invested here, but I’m watching the company closely and have it high on my list for some future investments to test the waters.

5. Peer to Peer Lending

This is the practice of lending money to individuals or businesses through online services that match lenders with borrowers.

Lenders can earn higher returns compared to savings and investment products offered by banks, while borrowers can borrow money at lower interest rates.

There is the risk of the borrower defaulting on the loans taken out from peer-lending websites. For what I’ve seen, the returns typically do not get much higher than 3-8% but could be something worth trying.

Some of the popular P2P sites in this space are:

- LendingClub (recognizable name)

- Prosper

- Upstart (Founded by ex-Googlers)

6. Invest in yourself (Side hustle)

I know, I know you might be thinking “what a cliche” statement, but this has to be said.

One of the best things you can invest some money into is in yourself.

By this, I mean starting a online business or a side hustle that has the potential to make you even more money in the near future.

Just like anything else, there are risks with investing in or starting your own business but it can be the best investment you’ll ever make.

How many times have you seen others start something for a few grand and then end up make thousands of dollars or sell the business for a nice chunk of change?

You never know if you don’t invest in yourself.

So, where do I currently invest my money?

A few years back when I started taking my finances seriously, I also started wondering where and what to invest my money in.

I built a whole budget spreadsheet that showed me where all my money was going and what I had left to save.

What I had to save is then what I took and started to figure out where to place that money.

This, of course, has changed since my salary has increased, my savings amount got larger, and just my general financial knowledge growing.

So right now, about 40% of my income goes to bills and student loan debt. This allows me to save roughly 60% of my income.

This I know is well above the average savings rate (average is less than 5%), but I also worked hard to get where I’m at today.

Below is a breakdown based on 100% roughly where my money currently goes for saving and investments.

Stock Market – 60%

- This includes my Roth IRA as I do not have a company 401k

- Brokerage account for higher interest returns and tax-advantaged funds

- Individual stocks (this accounts for about 2% of my total cash)

Savings – 20%

- Building my savings account too as most of this money will be used for other investing ventures outside of the stock market. But until I’m more comfortable and have enough saved, I will not be mindlessly dumping money into anything else.

Real Estate Crowdfunding – 10%

- I’ve chosen to rock with real estate crowdfunding at Groundfloor, where I diversify a small percentage of investment money each check to loans of 9% potential returns and up. It’s a relatively new space from non-accredited investors, but also a good way to diversify your investment portfolio and still snag some decent returns.

What I plan on investing in the near future

As you can see, I’m not fully diversified in other areas yet when it comes to investing, but getting there.

A big reason is I’m focused on paying the remaining debt I have as well as building my stock marketing portfolio and savings for bigger investments.

I plan on putting more into real estate crowdfunding.

Although actual real estate investing is interesting to me, I’m not knowledgeable or confident enough quite yet.

Plus, for rental properties, it can be a lot of work and real estate crowding funding simplifies that for me right now. A few friends of mine have also invested in Groundfloor and have seen 9-11% returns.

Additionally, I’ll be continuing to sock money away in my Roth IRA and in my brokerage account.

Where are you currently investing your money? Are you diversifying in any of the above? Why or why not? Let me know in the comments below.